Stock Market Outlook

For The Week Of May 5th =

Downtrend

INDICATORS

-

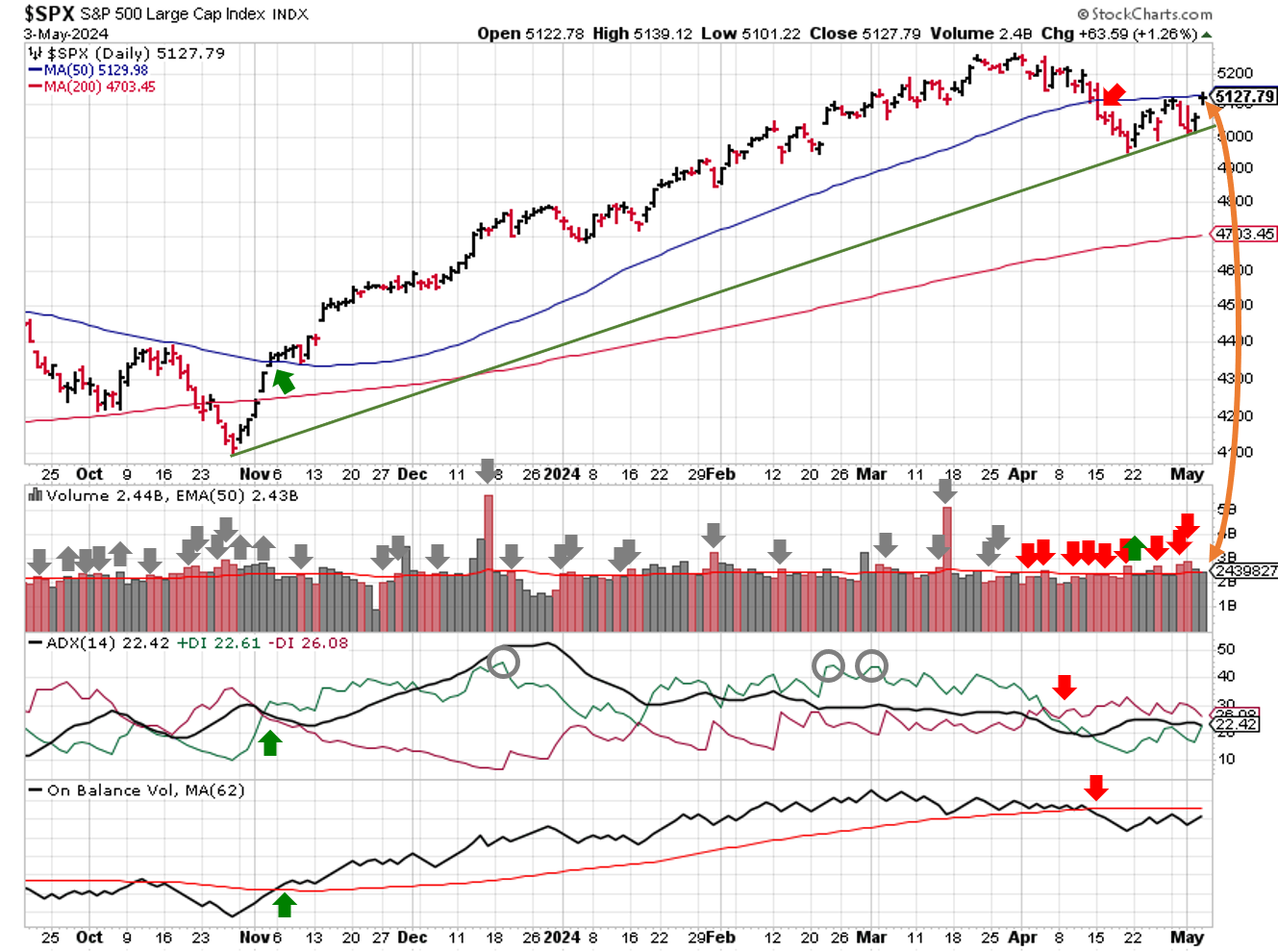

ADX Directional Indicators: Downtrend

Price & Volume Action: Downtrend

On Balance Volume Indicator: Downtrend

The stock market outlook The S&P500 ($SPX) rose 0.5% last week, reaching the 50-day moving average and sitting ~9% above the 200-day moving average.in a downtrend, though the SPX looks poised to test that signal this week.

SPX Technical Analysis entering the Week of May 05 2024

Price/volume remains bearish, despite Friday's gap higher. The session met the price increase criteria (+1.25%), but didn't come with the needed trading volume. Instead, added volume came in the form of 2 distribution days.

There's still time for the index to turn things around, but the odds of a robust rally drop further if the market doesn't follow-through within 11 days (5/7).

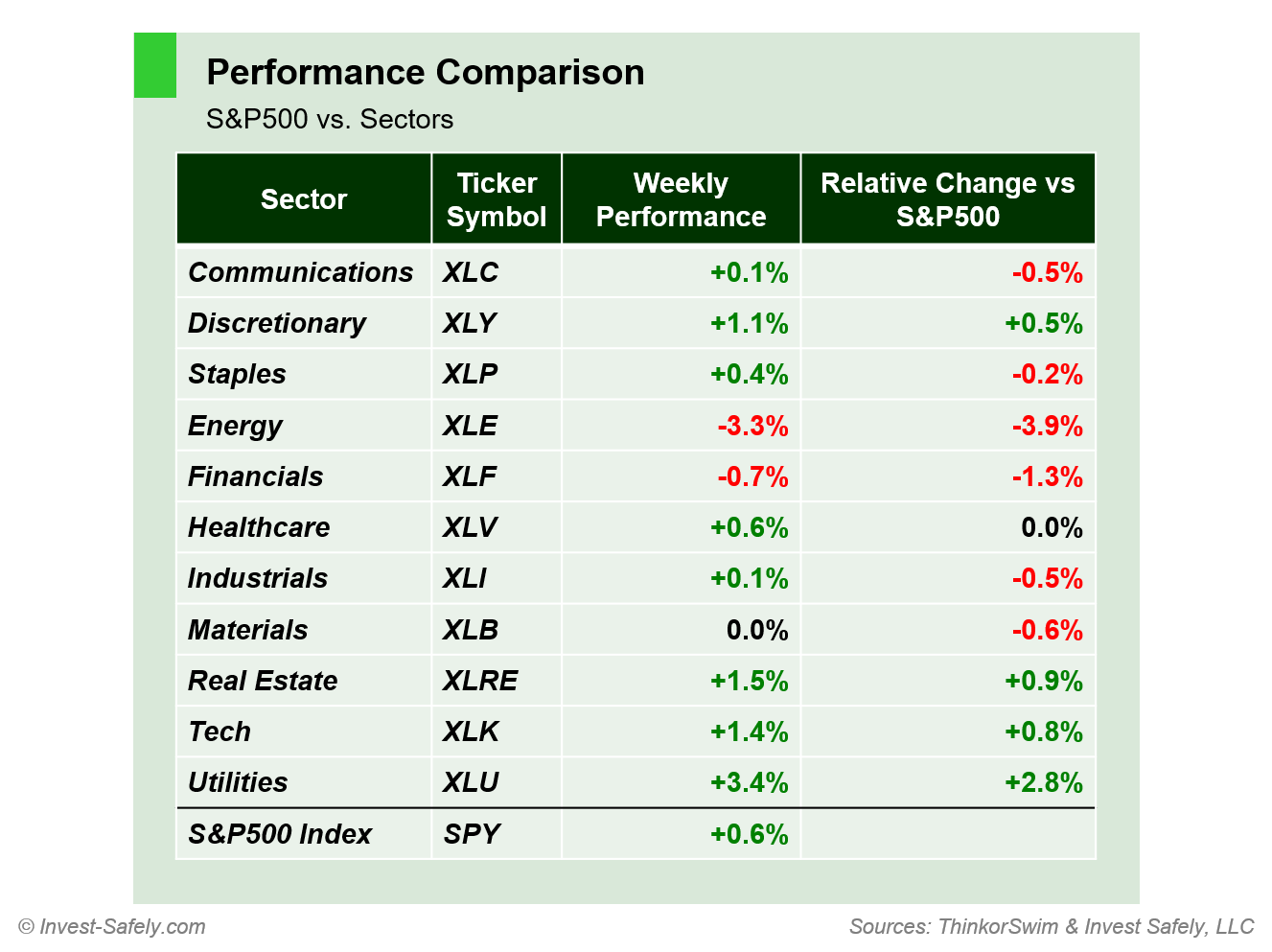

Within U.S. equities, most major sectors were green last week. Despite all the labor and inflation talk (and Apple earnings), Utilities ($XLU) outperformed the other sectors. Energy ($XLE) struggled again, largely due to the continued weakness in oil.

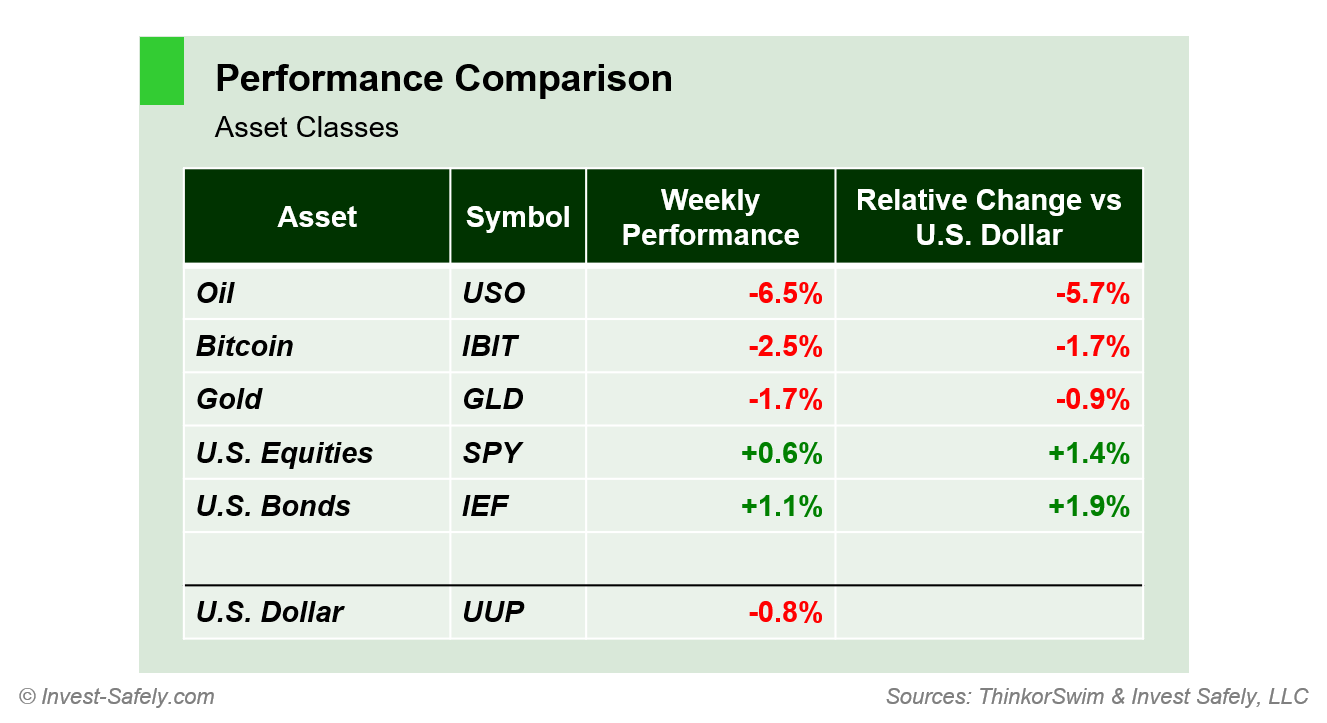

U.S. bonds were the best asset class last week, while oil dropped almost 7%.

COMMENTARY

The big news last week was the "Powell Pivot" during the FOMC press conference on Wednesday. Did you miss it? That's probably because the committee left rates unchanged, and said that inflation hadn't come down as much as they had hoped. Or maybe it was the surprise statement that the Federal Reserve will begin tapering Quantitative Tightening in June.

But the real story was Powell's remarks related to labor, and the renewed focus on employment, rather than inflation. Technically, the Federal Reserve's dual mandate mean they equally split their focus between labor and inflation. But job data remained strong (at least according to lagging data sources), giving them cover to focus on inflation. It appears that now, the labor market will play a larger roll in determine the potential for rate cuts.

Markets also cheered Powell's comments on the potential size and speed of any rate cuts later this year. When asked if he felt like the Federal Reserve was running out of time to get in "enough" rate cuts before year end, Powell flatly dismissed the notion. Fed watchers interpreted that as a willingness by Powell to use larger rate cuts, versus the prior 0.25% increments.

And as if on cue, Non-Farm Payrolls (NFP) came in lower than expected on Friday. Equities responded by gapping higher, while rates fell.

In other news, last week's ISM manufacturing and services PMI surprised to the downside, showing a contraction in the April data.

And not to be outdone by the likes of Tesla, Apple ($AAPL) overcame a less than stellar financial results by increasing their dividend and unveiling a massive, $110B buyback program during their earnings announcement. That's equivalent to the GDP of many small countries!

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don't, tell an enemy.

Sources: Bloomberg, CNBC, Federal Reserve Bank of St. Louis, Hedgeye, U.S. Bureau of Economic Analysis, U.S. Bureau of Labor Statistics

Share this Post on:

How to Make Money in Stocks: A Winning System in Good Times and Bad.

It's one of my favorites.

I regularly share articles and other news of interest on:

Twitter (@investsafely)

Facebook (@InvestSafely)

LinkedIn (@Invest-Safely)

Instagram (@investsafely)

Invest Safely, LLC is an independent investment research and online financial media company. Use of Invest Safely, LLC and any other products available through invest-safely.com is subject to our Terms of Service and Privacy Policy. Not a recommendation to buy or sell any security.

Charts provided courtesy of stockcharts.com.

For historical Elliott Wave commentary and analysis, go to ELLIOTT WAVE lives on by Tony Caldaro. Current counts can be found at: Pretzel Logic, and 12345ABCDEWXYZ

Once a year, I review the market outlook signals as if they were a mechanical trading system, while pointing out issues and making adjustments. The goal is to give you to give you an example of how to analyze and continuously improve your own systems.

- 2015 Performance - Stock Market Outlook

- 2016 Performance - Stock Market Outlook

- 2017 Performance - Stock Market Outlook

- 2018 Performance - Stock Market Outlook

- 2019 Performance - Stock Market Outlook

- 2020 Performance - Stock Market Outlook

IMPORTANT DISCLOSURE INFORMATION

This material is for general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purpose. Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisors of his/her choosing. Invest Safely, LLC is not a law firm, certified public accounting firm, or registered investment advisor and no portion of its content should be construed as legal, accounting, or investment advice.

The material is not to be construed as an offer or a recommendation to buy or sell a security nor is it to be construed as investment advice. Additionally, the material accessible through this website does not constitute a representation that the investments described herein are suitable or appropriate for any person.

Hypothetical Presentations:

Any referenced performance is “as calculated” using the referenced funds and has not been independently verified. This presentation does not discuss, directly or indirectly, the amount of the profits or losses, realized or unrealized, by any reader or contributor, from any specific funds or securities.

The author and/or any reader may have experienced materially different performance based upon various factors during the corresponding time periods. To the extent that any portion of the content reflects hypothetical results that were achieved by means of the retroactive application of a back-tested model, such results have inherent limitations, including:

Model results do not reflect the results of actual trading using assets, but were achieved by means of the retroactive application of the referenced models, certain aspects of which may have been designed with the benefit of hindsight

Back-tested performance may not reflect the impact that any material market or economic factors might have had on the use of a trading model if the model had been used during the period to actually manage assets

Actual investment results during the corresponding time periods may have been materially different from those portrayed in the model

Past performance may not be indicative of future results. Therefore, no one should assume that future performance will be profitable, or equal to any corresponding historical index.

The S&P 500 Composite Total Return Index (the "S&P") is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. Standard & Poor's chooses the member companies for the S&P based on market size, liquidity, and industry group representation. Included are the common stocks of industrial, financial, utility, and transportation companies. The S&P is not an index into which an investor can directly invest. The historical S&P performance results (and those of all other indices) are provided exclusively for comparison purposes only, so as to provide general comparative information to assist an individual in determining whether the performance of a specific portfolio or model meets, or continues to meet investment objective(s). The model and indices performance results do not reflect the impact of taxes.

Investing involves risk (even the “safe” kind)! Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of underlying risk. Therefore, do not assume that future performance of any specific investment or investment strategy be suitable for your portfolio or individual situation, will be profitable, equal any historical performance level(s), or prove successful (including the investments and/or investment strategies describe on this site).