Personal Financial Statements:

Know Before You Go

I'm going to let you in on a secret: Personal financial statements are the first thing you do when meeting with a financial planner.

They might call them something else, like "Your Financial Profile" or "Financial Data Worksheets". But they're just personal financial statements by a different name.

Heading to those meetings with all your finances in-hand and ready to go will save you a ton of time. Without your actual data (income, taxes, expenses, etc.), you'll have to use your best guess during the meeting, then go home and do it all over again with the right numbers. Then, you'll be back for a follow-up visit...one that could cost money.

What are Financial Statements?

Financial statements are a standardized tool used by companies to report financial performance.The forms allow people inside (and outside if the company is "public") to see a firms money management skill or lack thereof.

Reading a corporate financial statement is the backbone of all fundamental analysis.

The same can be said about your personal finances; being able to make a personal financial statement is key to getting control of your money.

As an added bonus, once you understand how your own personal finance statements fit together, you will already understand a lot of what it takes to read and understand corporate financial statements as well!

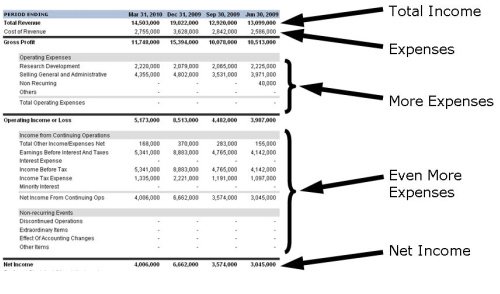

Corporate Income Statement Example - Microsoft June 2009

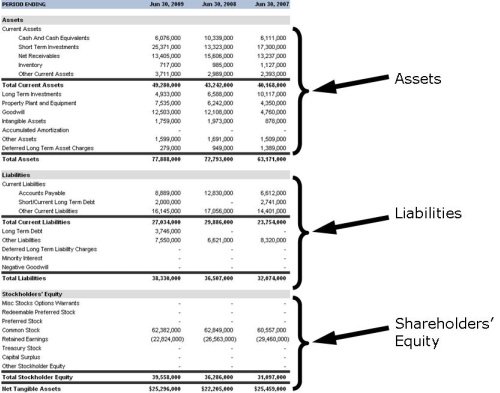

Corporate Balance Sheet Example - Microsoft June 2009

What are Personal Financial Statements?

If you asked someone "What's your salary" or "How much money do you make", 99.9% of the population could tell you an exact dollar amount.If you asked those same people how much profit they had at end of the year, less than 10% could give you an answer.

And it's amazing what else that 10% can tell you. They can tell you what their biggest expense is and how they are actively working to make it smaller. They can tell you how much money they have left on their car loan, and when they plan to pay it off. I could go on and on, but the point is that these people can describe their finances in detail.

Can you describe your current financial situation? If not, I'm willing to bet it's because you don't have personal financial statements.

Your current situation is the result of the choices you've made so far, even if you weren't actively managing your finances. Your profession, your home, and all your possessions have had or will continue to have an impact.

The best technique for assessing and then managing personal finances is to create personal financial statements, similar to those that are used to evaluate a company's finances.

The Personal Income Statement

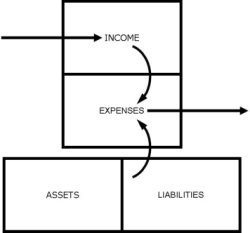

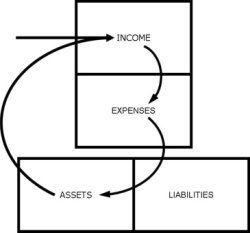

The income statement allows you to see the relationship between income (from selling goods and services) and expenses (the cost of running a business). A personal income statement allows you to see where you get your money (from selling your services) and where you spend that money (the cost of living your lifestyle).Relationship Between Income and Expenses

Click here for more detail on how to make your "personal income statement".

The Personal Balance Sheet

A balance sheet shows the relationship between the financial positives and negatives of running a business. In other words, the assets and liabilities. An asset is a physical object that you own and creates value. A liability, on the other hand, is something that is owed (someone else's asset).

Influence of Assets & Liabilities on Income & Expenses

The reason for the term "balance sheet" is that in corporate finance, the value of the assets and liabilities must balance out (i.e. be equal). Ideally, a companies assets are worth more than the liabilities, so there is value left over. Shareholder equity is the "value" of a company after all liabilities are paid in full.

From a personal perspective, the same balancing act is also true. If your assets are worth more than your liabilities, you have value left over in the form of your "net worth". Visit our page on Personal Balance Sheets to learn how to calculate your net worth.

The Personal Cashflow Statement

At this point, you've got all your numbers. The corporate statements mentioned above contain income, expense, asset, and liability data from specific points in time (in this case, June of 2007, 2008, and 2009).The REAL understanding of a financial situation comes when you combine the income statement with the balance sheet. This is called the "Statement of Cashflow" or a "Cashflow Statement".

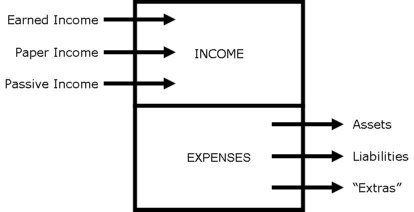

Cashflow Diagram - Middle Class

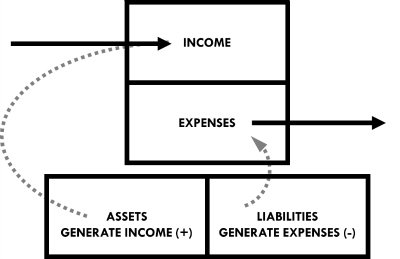

Cashflow Diagram - Rich

The corporate version allows you to see how a company makes money and then what it does with that money. Income could be from selling goods and services or accumulating debt. Expenses could be high because the company is buying a lot of assets or because it has many liabilities to pay off debt. Over time, you can see patterns emerge, allowing you to see which companies are overachieving and which are underachieving.

Similar to the corporate cashflow statement, a personal cashflow diagram is a great way to combine your balance sheet and income statement into one clear picture. And that picture created is truly amazing.

Visualizing your finances this way makes personal budgeting a lot easier to understand. Cash literally "flows" between assets, income, expenses, and liabilities. You can also clearly see the sources: income is created by assets (remember that your skills are an asset), while expenses are created by liabilities.

And just like over and under achieving companies, the cashflow patterns associated with the rich and the middle class are very different, and have a profound impact on financial success.

Why are Personal Financial Statements Important?

Because safe investing starts with you and your personal finances. Like it or not, money is an important part of modern life. It is the method we use to exchange our services for someone else's.I don't know about you, but I don't see myself killing chickens in my backyard anytime soon. So I am dependent on paying a farmer to do that for me.

And you don't need all your numbers to be spot-on to get started. I think I've updated my spreadsheets every year, because my tracking needs have changed or because I want to look at my numbers differently.

As I got smarter, my personal financial statements changed. I saw different trends, created new charts and graphs...even warned myself of potential problems with my automated withdrawals!

The actual numbers that you put into a spreadsheet are not as important as the "picture" the spreadsheet creates.

Click here to create your own cashflow diagram and begin organizing your personal finances.