2016 Performance

Stock Market Outlook

It's that time! Time to figure out evaluate our weekly market review the 2016 Performance Review for the Invest Safely Stock Market Outlook.

As you know, safe investing is a path to wealth, based on aggressively protecting your capital from losses.

As you know, safe investing is a path to wealth, based on aggressively protecting your capital from losses.

In 2015, the market outlook accomplished exactly that; following the signals limited losses and actually generated some gains, while returns from the general markets were flat or even negative.

At first glance, 2016 was not so kind...but that seems to be a theme from last year. Using the 2015 criteria, returns from the market outlook were lower than a simple buy and hold strategy.

Wait, what?

This was a bit of a shock; as the year progressed, I didn’t feel that the outlook was that far off. So I was left with the question, "How could the model have under-performed so much?"

Digging into the results, I found some price slippage; the price movement during the time between a signal and the trade. Ideally, you'd try to make this as small as possible.

The good news? All the price slippage is generated by me when I simulate trades based on the market outlook. In other words, the model was good. It’s after-the-fact calculations that are the trouble makers.

Adjusting the trading criteria (i.e. the price I use to calculate entry and exit positions) made the results much better. Not great, but acceptable given the black swan events we witnessed last year (Brexit and the US election).

Going back to 2015, the outlook outperforms buy and hold, and we still haven't witnessed a bear market. Overall, I'd say that looks like success.

I may even be able to improve the accuracy of signal's generated, but that's a research topic for a different day.

2016 Market Outlook Performance = Meh

Plan, do, check, act: the simple, four step management process popularized by Edward Deming. After another year of doing, it's time to check the outcomes, see just how well (or poorly) the weekly "Stock Market Outlook" performed in 2016, and act on anything that can be improved.

The 2016 results aren't great. I actually ran the numbers twice because I figured I made an error in Excel.

| Symbol | Type | Buy/Hold ROI | Outlook ROI | |

| S&P500 | ^GSPC | Index | 9.8% | 4.8% |

| S&P500 | SPY | ETF | 11.4% | 3.9% |

| S&P500 | FXSIX | Mutual Fund | 10.6% | 2.9% |

| Nasdaq | QQQ | ETF | 8.1% | 4.8% |

| Russell 2000 | IWM | ETF | 21.9% | 5.8% |

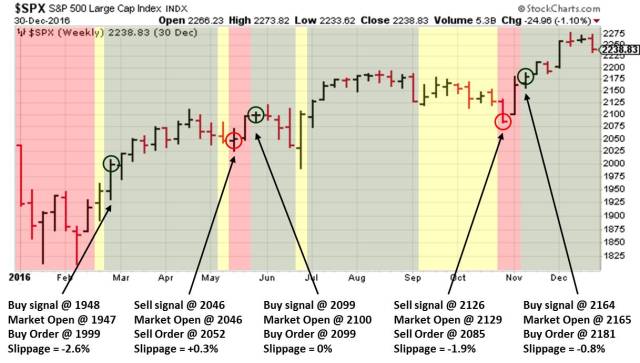

By highlight buy points and sell points graphically, spotting problems is much easier. Right away, I see two potential issues:

- Price slippage after a trend change (buy/sell price selection)

- Delayed downtrend signals (buy/sell signal generation)

“actual investment results during the corresponding time periods may be materially different”

“performance does not reflect the results of actual trading using assets, but were achieved by means of the retroactive application of models and market conditions”

If there is a fix in this area, 2016 may not be such a disaster.The second issue concerns signal generation (uptrend, mixed, downtrend). Improvements here require new rules, generating new signals, simulating new trading prices, and then making an A to B comparison of the original model and the new model.

As you can see, a fix in this area is more involved. In the end, the improvements will help 2017 performance, but don't change the blog posts made last year. And of course, this activity comes with its own unique disclaimer:

Back-tested performance may not reflect the impact that market or economic factors might have had on the use of a trading model (if the model had been used during the period to actually manage assets).

A future blog post perhaps...

Analysis – Price Slippage

Price slippage is the price movement during the time between signal generation and the actual “buy” price. In the case of the market outlook, the slippage is a function of the weekly closing prices used to simulate trades. In fact, here’s what I said last year concerning this very subject (here):

Stock markets can fluctuate quite a bit during the trading week, which makes the weekly review lag the market. Also, trend changes aren’t nice enough to change at the same time every week. Thinking that a change will happen at the end of every week is like expecting fellow drivers to use their turn signals. Not gonna happen. So using Friday’s closing price as the buy or sell price will not always match the price level that triggered the change in trend.

At least I can say that statement is spot on.The first trade, in late February, shows one of the mismatches I was worried about last year. The market outlook started the year “in cash” so to speak, as there was a downtrend in place. After the market reached 1,948 during the week of February 29th, the outlook changed to an uptrend.

The following week, the market opened at 1,947. Unfortunately, the market rose 2.6% by the end of the week. My performance calculation “missed” a gain of 2.6% due to slippage between the “uptrend signal” and my simulated “buy order” because I used the weekly closing price AFTER the signal was generated.

By evaluating price slippage for each trade, we see the following: 2 more trades negatively affected, one that was positively affected, and one which was unaffected.

By evaluating price slippage for each trade, we see the following: 2 more trades negatively affected, one that was positively affected, and one which was unaffected.

In total, slippage reduced returns by ~5%! And that's about the same amount the outlook under-performed the S&P500 index. Of course, the price slippage was never entirely real; probably more like a worst case. You and I would have placed an order as soon as possible after reading the Sunday update (i.e. most likely the Monday morning).

Conclusion? The way that I simulated real-world results wasn't very real-world, and making an adjustment is worthwhile.

Adjustment - Buy/Sell Price Selection

The market outlook posts on Sunday, based on the prior week’s market activity. Because I used a weekly timeframe for the results, I can either choose the weekly opening price or the closing price.

For simulation purposes, I chose the Friday closing price AFTER a signal change as the “buy price”. This meant that all of that week’s price action (good or bad) was not showing up in my simulated results.

So I came up with two options for simulating buy and sell prices:

- Use a weekly timeframe, and simulate buy/sell prices using the weekly (Monday’s) opening price

- Use a daily timeframe, and simulate buy/sell prices using Monday’s closing price

On the other hand, I’m 100% confident that no one (myself included) would wait an entire week to make a trade after getting a signal.

If I go with Option 1 (keep the weekly data and using the opening price as my “buy” price):

| Symbol | Type | Buy/Hold ROI | Outlook ROI | |

| S&P500 | ^GSPC | Index | 9.8% | 10.4% |

| S&P500 | SPY | ETF | 11.4% | 9.3% |

| S&P500 | FXSIX | Mutual Fund | 10.6% | 10.5% |

| Nasdaq | QQQ | ETF | 8.1% | 11.4% |

| Russell 2000 | IWM | ETF | 21.9% | 15.1% |

I still see significant differences for the NASDAQ and the Russell 2000, but am not too surprised. My signals are based on the S&P500, and it's possible for other indexes to lead and lag at any given point in time.

I also checked price slippage over the weekend (from Friday's close to Monday's open). During 2016, the highest price change between a Friday close and a Monday open was 0.7%, the lowest was -0.4%. The mean and the median were both 0%.

If I go with Option 2 (daily prices instead of weekly, and with Monday’s closing price as the buy price):

| Symbol | Type | Buy/Hold ROI | Outlook ROI | |

| S&P500 | ^GSPC | Index | 9.8% | 12.3% |

| S&P500 | SPY | ETF | 11.4% | 11.6% |

| S&P500 | FXSIX | Mutual Fund | 10.6% | 10.5% |

| Nasdaq | QQQ | ETF | 8.1% | 14.0% |

| Russell 2000 | IWM | ETF | 21.9% | 16.6% |

I still believe that we (individual investors) won’t always be able to trade at Monday’s opening price. That said, assuming that Monday’s closing price will always improve performance is wishful thinking. The reality falls somewhere in between, and so does the performance.

Option 1 is the better alternative for simulating trades for the Market Outlook.

Moving Forward

In summary, it’s pretty obvious that using closing prices the week following a signal change dramatically impacted investing performance. The issue is one you'll experience any time you try to back-test your system; prices will never be 100% correct. Remember: All models are wrong, but some are useful.

The objective here is not to be right or wrong. Instead, it's to improve performance. By showing you some analysis (which closely mimics the one used for all my trades), I'm giving you an example of the safe investing processes in action.

And on that note, here’s a toast to you, your friends, and your family! Wishing you the best in 2017!

Best Regards, Joel

Joel Wenger

Founder

Invest Safely, LLC

If you find this research helpful, please tell a friend. I share articles and other news of interest via Twitter; you can follow me @investsafely. The weekly market outlook is also posted on Facebook and Linkedin.

APPENDIX

Methodology

I carried forward the methodology from 2015; using 3 trading methodologies and subjectively combining them into a weekly market outlook.Every Sunday, I review the previous week’s market action and decide whether the outlook (uptrend, mixed, or downtrend) has changed, based on the signals from the 3 trading methodologies.

- 20, 50, and 200 day moving averages

- Price/volume, distribution days, follow-through days

- Objective Elliott Wave (via Tony Caldero)

Trading Criteria – Investment Type

Since we can’t directly buy shares of an index, we need to go with the next best thing; funds. I chose two S&P funds (SPDR SPY and Fidelity FXSIX) based on their common availability in individual and retirement trading accounts, as well as a fund based on the NASDAQ (Powershares QQQ) and Russell 2000 (iShares IWM), to see how well the signals translate across the various market average types and providers.Trading Criteria - Buy and Sell Prices

The forward looking outlook (uptrend, downtrend, mixed) is posted on Sunday, based on stock market price action from the prior week. Since that week is already in the books, there is no way for you to "trade" at the same prices that shaped the outlook. As discussed earlier, the “price” used for calculating performance is now the market open price the week following a signal change.Trading Criteria - Transaction Fees

I'm assuming that trades are placed in an account with Fidelity, so transactions cost $7.95 per trade. Everyone should be using a low cost broker, and there are several with lower costs than Fidelity...FYI.Trading Criteria - Position Sizing

For this study, I used a position size of 100 shares to keep the math simple. If I were buy shares of an index ETF, position size would be customized based on the size of my total portfolio and my risk tolerance (how much I’m willing to lose before selling the position).Trading Criteria - Buy and Sell Signals

Shares are purchased if the market outlook changes to an uptrend. If the outlook is mixed, watch and wait. If the outlook changes to a downtrend, the entire position is sold.Issues & Objections - Trade Prices

If a signal is generated, simulated trades are entered between the market's opening price on the following Monday (the day after the outlook is posted) and the closing price on Friday afternoon. In 2015, I used Friday's weekly closing price as my buy/sell price for any trade for two reasons:- Catching the relative high or low during the week isn't feasible for 95% of the people reading this blog

- You will rarely, if ever, get the opening price

Issues & Objections - Trends & Timing

Are you always going to buy an uptrend, sit on your hands when the market is "mixed", or sell exactly when a downtrend takes hold? No. General trends are great for giving you a sense of the overall investing environment. But each of your positions needs to be evaluated on its own merits.Data

For the analysis, I used historical data from Yahoo Finance.| Week | Date | Signal | S&P500 | (^GSPC) |

| Open | Close | |||

| 52 | 12/27/2016 | Uptrend | 2266.23 | 2238.83 |

| 51 | 12/19/2016 | Uptrend | 2259.24 | 2263.79 |

| 50 | 12/12/2016 | Uptrend | 2258.83 | 2258.07 |

| 49 | 12/5/2016 | Uptrend | 2200.65 | 2259.53 |

| 48 | 11/28/2016 | Uptrend | 2210.21 | 2191.95 |

| 47 | 11/21/2016 | Uptrend | 2186.43 | 2213.35 |

| 46 | 11/14/2016 | Uptrend | 2165.64 | 2181.90 |

| 45 | 11/7/2016 | Downtrend | 2100.59 | 2164.45 |

| 44 | 10/31/2016 | Downtrend | 2129.78 | 2085.18 |

| 43 | 10/24/2016 | Mixed | 2148.50 | 2126.41 |

| 42 | 10/17/2016 | Mixed | 2132.95 | 2141.16 |

| 41 | 10/10/2016 | Mixed | 2160.39 | 2132.98 |

| 40 | 10/3/2016 | Mixed | 2164.33 | 2153.74 |

| 39 | 9/26/2016 | Mixed | 2158.54 | 2168.27 |

| 38 | 9/19/2016 | Mixed | 2143.99 | 2164.69 |

| 37 | 9/12/2016 | Mixed | 2120.86 | 2139.16 |

| 36 | 9/6/2016 | Uptrend | 2181.61 | 2127.81 |

| 35 | 8/29/2016 | Uptrend | 2170.19 | 2179.98 |

| 34 | 8/22/2016 | Uptrend | 2181.58 | 2169.04 |

| 33 | 8/15/2016 | Uptrend | 2186.08 | 2183.87 |

| 32 | 8/8/2016 | Uptrend | 2183.76 | 2184.05 |

| 31 | 8/1/2016 | Uptrend | 2173.15 | 2182.87 |

| 30 | 7/25/2016 | Uptrend | 2173.71 | 2173.60 |

| 29 | 7/18/2016 | Uptrend | 2162.04 | 2175.03 |

| 28 | 7/11/2016 | Uptrend | 2131.72 | 2161.74 |

| 27 | 7/5/2016 | Uptrend | 2095.05 | 2129.90 |

| 26 | 6/27/2016 | Mixed | 2031.45 | 2102.95 |

| 25 | 6/20/2016 | Uptrend | 2075.58 | 2037.41 |

| 24 | 6/13/2016 | Uptrend | 2091.75 | 2071.22 |

| 23 | 6/6/2016 | Uptrend | 2100.83 | 2096.07 |

| 22 | 5/31/2016 | Uptrend | 2100.13 | 2099.13 |

| 21 | 5/23/2016 | Downtrend | 2052.23 | 2099.06 |

| 20 | 5/16/2016 | Downtrend | 2046.53 | 2052.32 |

| 19 | 5/9/2016 | Mixed | 2057.55 | 2046.61 |

| 18 | 5/2/2016 | Uptrend | 2067.17 | 2057.14 |

| 17 | 4/25/2016 | Uptrend | 2089.37 | 2065.30 |

| 16 | 4/18/2016 | Uptrend | 2078.83 | 2091.58 |

| 15 | 4/11/2016 | Uptrend | 2050.23 | 2080.73 |

| 14 | 4/4/2016 | Uptrend | 2073.19 | 2047.60 |

| 13 | 3/28/2016 | Uptrend | 2037.89 | 2072.78 |

| 12 | 3/21/2016 | Uptrend | 2047.88 | 2035.94 |

| 11 | 3/14/2016 | Uptrend | 2019.27 | 2049.58 |

| 10 | 3/7/2016 | Uptrend | 1996.11 | 2022.19 |

| 9 | 2/29/2016 | Uptrend | 1947.13 | 1999.99 |

| 8 | 2/22/2016 | Mixed | 1924.44 | 1948.05 |

| 7 | 2/16/2016 | Downtrend | 1871.44 | 1917.78 |

| 6 | 2/8/2016 | Downtrend | 1873.25 | 1864.78 |

| 5 | 2/1/2016 | Downtrend | 1936.94 | 1880.05 |

| 4 | 1/25/2016 | Downtrend | 1906.28 | 1940.24 |

| 3 | 1/19/2016 | Downtrend | 1888.66 | 1906.90 |

| 2 | 1/11/2016 | Downtrend | 1926.12 | 1880.33 |

| 1 | 1/4/2016 | Downtrend | 2038.20 | 1922.03 |

2015 Performance Revisited

Since we’re changing trading criteria, it’s only fair to recalculate 2015 performance using Option 1. Again, the signals are not changing; only the price selected to represent entry and exit.| Symbol | Type | Buy/Hold ROI | Outlook ROI | |

| S&P500 | ^GSPC | Index | -0.5% | 3.4% |

| S&P500 | SPY | ETF | -0.2% | 2.4% |

| S&P500 | FXSIX | Mutual Fund | 0.2% | 2.2% |

| Nasdaq | QQQ | ETF | 9.0% | 10.3% |

| Russell 2000 | IWM | ETF | -4.7% | -1.5% |

2015-2016 Total Return

Now I'll calculate returns since the start of 2015 using Option 1:| Symbol | Type | ROI Buy/Hold | ROI Market Outlook | |

| S&P500 | ^GSPC | Index | 9.0% | 11.2% |

| S&P500 | SPY | ETF | 9.4% | 14.1% |

| S&P500 | FXSIX | Mutual Fund | 9.3% | 14.9% |

| Nasdaq | QQQ | ETF | 15.4% | 23.3% |

| Russell 2000 | IWM | ETF | 13.9% | 14.7% |

A Note on Investment Processes: From an investment management perspective, I’ve used trend following for many years. I find that reviewing rules-based indicators each week helps me stay disciplined.

Hypothetical Presentations: To the extent that any portion of the content reflects hypothetical results that were achieved by means of the retroactive application of a back-tested model, such results have inherent limitations, including:

- Model results do not reflect the results of actual trading using assets, but were achieved by means of the retroactive application of the referenced models, certain aspects of which may have been designed with the benefit of hindsight

- Back-tested performance may not reflect the impact that any material market or economic factors might have had on the use of a trading model if the model had been used during the period to actually manage assets

- Actual investment results during the corresponding time periods may have been materially different from those portrayed in the model

Certain information contained herein has been obtained from third-party sources believed to be reliable, but I cannot guarantee its accuracy or completeness.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses, realized or unrealized, by me, from any specific funds or securities.

Investing involves risk (even the “safe” kind)! Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy be suitable for your portfolio or individual situation, will be profitable, equal any historical performance level(s), or prove successful (including the investments and/or investment strategies describe on this site). No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.