Why Personal Finance Is Your Most Important Investment

If you’ve ever felt like your money disappears faster than your paycheck arrives, you’re not alone. Many households live paycheck to paycheck—even at higher incomes. The good news: personal finance isn’t about perfection; it’s about making your money do what matters most to you.

Think of your financial life like a small business you run. Healthy businesses track income and expenses, set goals, budget, review results, and adjust strategy. This guide walks you through the same five-step system for your money—so you can stabilize, plan, execute, monitor, and grow with confidence and safe investing in mind.

Step 1: Stabilize Your Situation Using Personal Financial Statements 📊

Before you can grow wealth, you need a clear, current picture of where you stand. That’s where personal financial statements come in.

Personal Income Statement

Your personal income statement summarizes your monthly and annual income and expenses.

It answers the question: “Am I living within my means?”

Examples

- Income:

- Earned Income (Paychecks)

- Paper Income (Interest, Dividends)

- Expenses:

- Pre-Tax Expenses ( 401k contribution, Insurance )

- Tax Expenses (Federal & State Income Tax, Medicare, Social Security )

- After-Tax Expenses (Mortgage, Car Payment, Utilities, Food, Credit/Debit Card payments, etc. )

Personal Balance Sheet

Your personal balance sheet lists what you own ( assets ) and what you owe ( liabilities ).

It answers the question: What's my your net worth.

Examples

- Assets:

- House

- Vehicles

- Insurance Policies

- Financial Accounts ( Savings, Investment, Retirement )

- Liabilities:

- Mortgage ( 401k contribution, Insurance )

- Loans ( Student, Car, etc. )

- Credit Card Balances

Your income statement tells you if you’re living within your means; your balance sheet shows your capacity to grow. Together, they stabilize your decision-making.

Check out the following links for our guides on creating your own statements

Step 2: Plan for Your Future Using Personal Financial Goals 🎯

Now that you're serious about building wealth so you can start investing safely, you need to set some personal financial goals. Our guide lays out foundational steps that anyone - regardless of their income, experience or expenses - can use to gain control over their financial future.

8 Personal Finance Goals from Invest-Safely.com

- Organize Your Finances

- Pay Yourself First

- Start an Emergency Fund

- Pay-off Debt with High Interest Rates

- Open a Retirement Account

- Pay-off Debt with Low Interest Rates

- Save a Down-Payment for a Home (if necessary)

- Begin Working on your own Safe Investing Strategies

Check out the following links for our guides on creating your own personal financial goals

Step 3: Execute Your Plans Using Personal Budgeting 📅

A budget isn’t a diet—it’s a roadmap. You’re assigning jobs to every dollar so your money works where it matters most.

Step 4: Monitor Your Progress Using Personal Financial Statements 📈

Reviewing your numbers is how you learn faster and correct sooner. What gets measured gets managed.

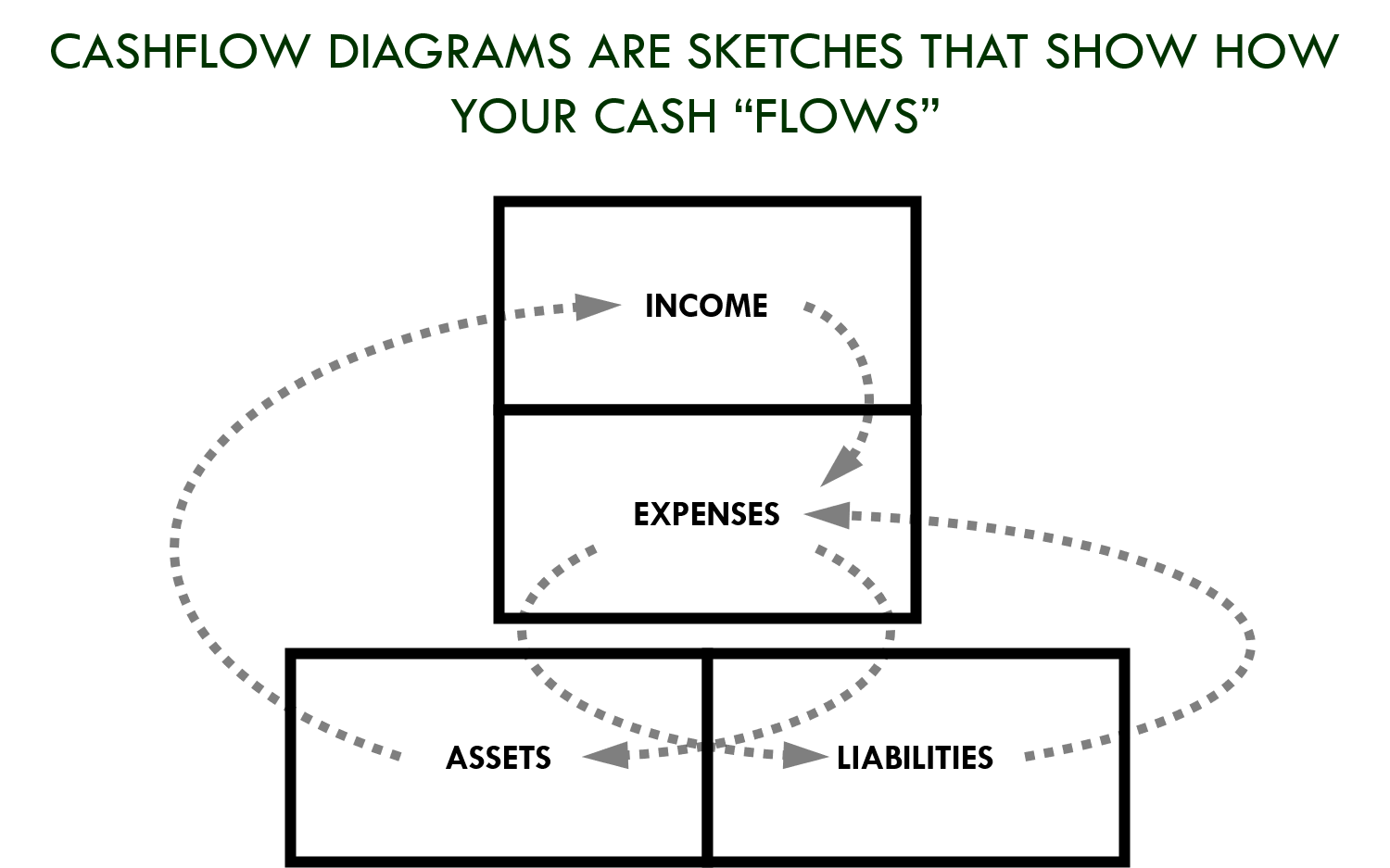

Personal Cash Flow Statement

See how money actually moves in and out of your accounts over time. It’s a financial health check, not just a snapshot.

Check out the following links for our guides on interpreting cashflow statements

- Connecting Your Personal Financial Statements

- Assessing Your Finances Using Cashflow Statements

- Money Management for Financial Freedom

- Top 10 Money Management Tips to Beat the Rat Race

- Personal Money Management - Adjust as You Grow

- Trading Money Management - Adjust as You Gain

- Create your income statement and balance sheet today.

- Set one 90-day goal and one 12-month goal.

- Choose a budgeting method and try it for 30 days.

- Schedule a quarterly financial review.

- Learn one new investing concept each month.

Step 5: Adjust As You Grow Using Personal Money Management 🌱

As your life changes, your money strategy should too. Preserve, then profit, then compound safely.

Capital Preservation: Income = Expenses (Breakeven)

When you’re at breakeven, create a surplus by cutting non-essentials or adding income streams. Protect cash flow first. 🛡️

Consistent Returns: Income > Expenses (Profit)

Use surplus intentionally: emergency fund top-ups, high-interest debt payoff, then diversified investing that matches your risk tolerance.

Superior Profits: Income into Assets (Safe Investing)

Channel consistent surplus into assets that compound without taking unnecessary risk.

Check out the following links for our guides on money management

Your Money, Your Future

Personal finance is progress over perfection. Stabilize your situation, set clear goals, budget with intention, monitor results, and adjust as you grow. That’s personal money management for safe investing.

Quick Start Checklist ✅

Want a simple dashboard to track all five steps? Build a one-page view with balances, cash flow, savings rate, debt status, and allocation. Keep it mobile-friendly for weekly check-ins. 📱