Stock Market Outlook

For The Week Of August 1st = Uptrend

INDICATORS

-

ADX Directional Indicators: Uptrend

Price & Volume Action: Mixed

Elliott Wave Analysis: Uptrend

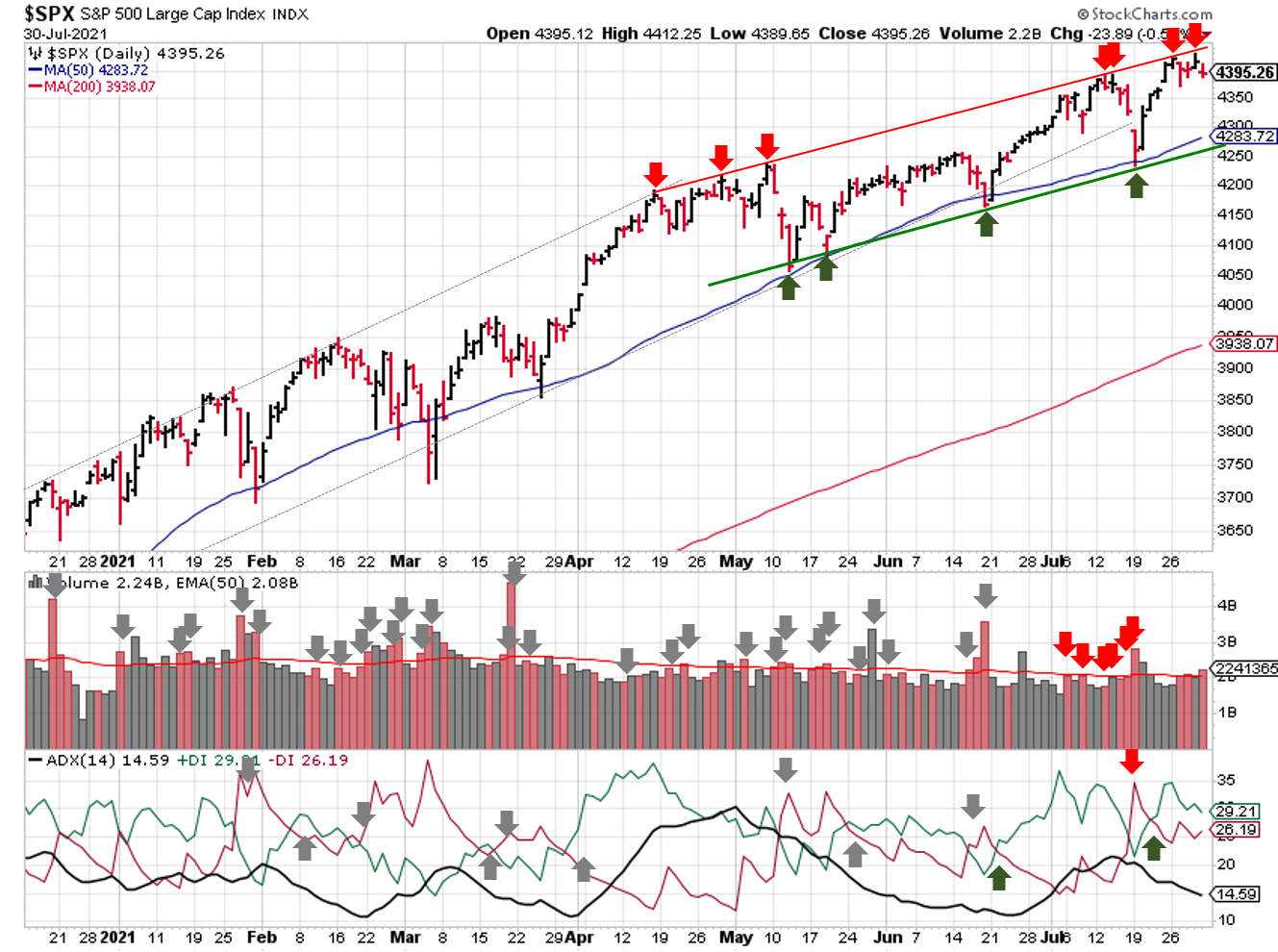

Fairly flat week for the S&P500 ($SPX) with the index hitting resistance at the upper channel line twice. It currently sits just off all time highs, ~3% above the 50-day moving average, and more than 10% above the 200-day moving average.

2021-08-01-SPX Trendline Analysis - Daily

The ADX remains bullish, but the overall trend is weaken again.

The S&P also picked up 2 distribution days, coincidentally after testing the upper channel. At first glance, it appears to have added 3 distribution days, but 1 didn't meet the price movement criteria. Wednesday’s close (vs. Tuesday’s close) dropped less than 0.2%. Either way, the count remains elevated, so the signal stays at “mixed” with price above the 50-day.

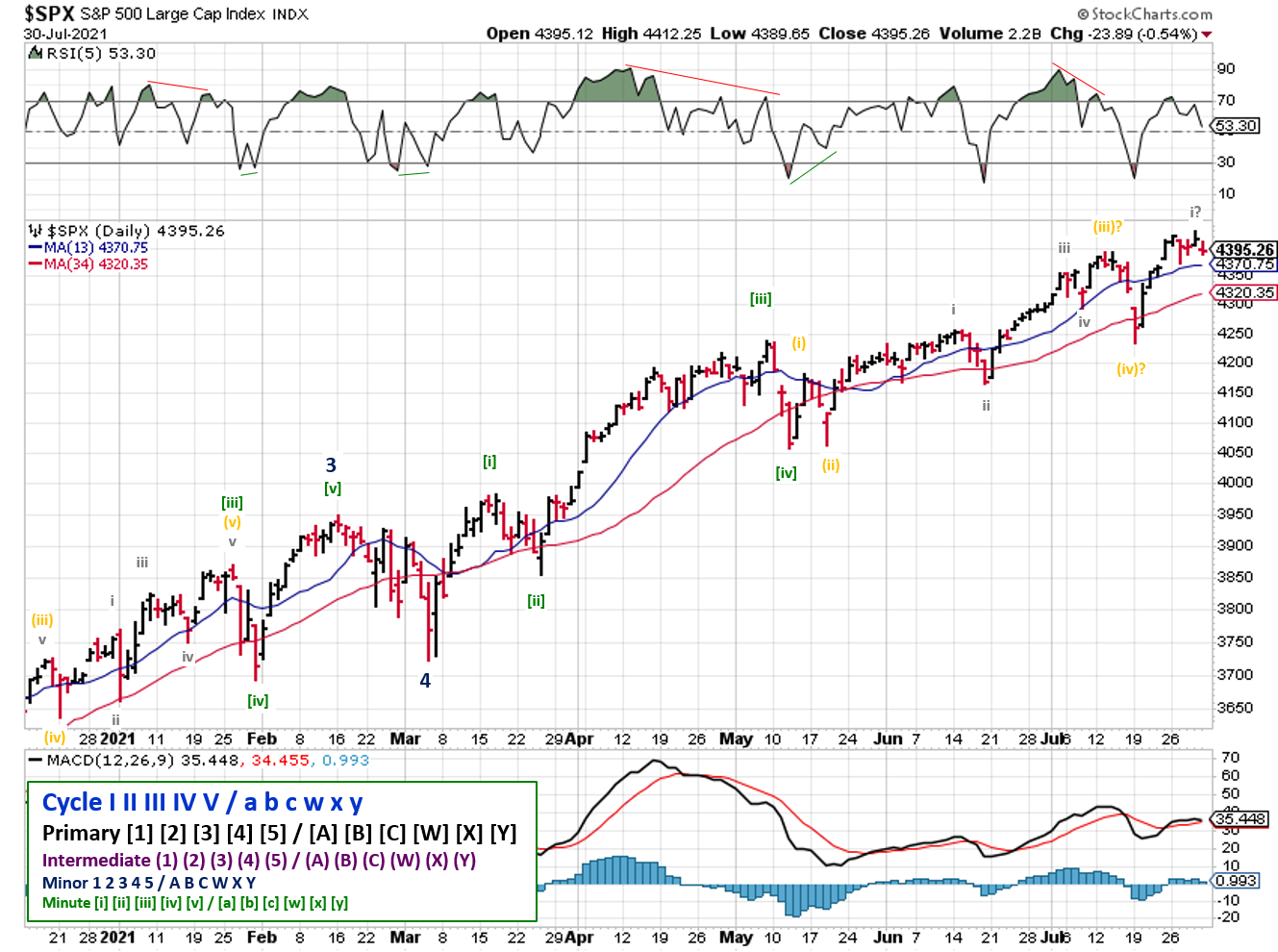

2021-08-01-SPX Elliott Wave Analysis - Daily - Primary 1

The uptrend signal from Elliott Wave rolls into another week...If wave i peaked on Thursday, wave ii could drop as low as 4225 before running back to all time highs.

We haven’t checked the longer-term view in a while. The chart on the left aligns with the chart above, showing the 5th wave extension we’ve discussed a few times in the past. The chart on the right is an alternative view, proposed by a reader, asking what the count looks like if the Primary 1 wave ended with August’s sell-off. In both cases, it appears a correction is closer than it is farther away.

2021-08-01-SPX Elliott Wave Analysis - Weekly - Cycle 2

COMMENTARY

Earnings season started off pretty well, though some well known technology companies sold off surprisingly hard after reporting. But it's next quarter's earnings when we'll begin to see post-COVID performance become the baseline for y-o-y comparisons.

A nothing-burger from the Fed last week; appears that they will continue to think about when to start thinking about telling us their thinking about normalizing financial policy.

Best to Your Week!

If you find this research helpful, please tell a friend. If you don't find it helpful, tell an enemy.

I regularly share articles and other news of interest via on Twitter (@investsafely), Facebook, Linkedin, and Instagram (@investsafely)

How to Make Money in Stocks: A Winning System in Good Times and Bad.

It's one of my favorites.

Charts provided courtesy of stockcharts.com.

For historical Elliott Wave Analysis, go to ELLIOTT WAVE lives on by Tony Caldaro. Other interpretations can be found at: Pretzel Logic, and 12345ABCDEWXYZ

Once a year, I review the market outlook signals as if they were a mechanical trading system, while pointing out issues and making adjustments. The goal is to give you to give you an example of how to analyze and continuously improve your own systems.

- 2015 Performance - Stock Market Outlook

- 2016 Performance - Stock Market Outlook

- 2017 Performance - Stock Market Outlook

- 2018 Performance - Stock Market Outlook

- 2019 Performance - Stock Market Outlook

- 2020 Performance - Stock Market Outlook

IMPORTANT DISCLOSURE INFORMATION

This material is for general communication and is provided for informational and/or educational purposes only. None of the content should be viewed as a suggestion that you take or refrain from taking any action nor as a recommendation for any specific investment product, strategy, or other such purpose. Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisors of his/her choosing. Invest Safely, LLC is not a law firm, certified public accounting firm, or registered investment advisor and no portion of its content should be construed as legal, accounting, or investment advice.

The material is not to be construed as an offer or a recommendation to buy or sell a security nor is it to be construed as investment advice. Additionally, the material accessible through this website does not constitute a representation that the investments described herein are suitable or appropriate for any person.

Hypothetical Presentations:

Any referenced performance is “as calculated” using the referenced funds and has not been independently verified. This presentation does not discuss, directly or indirectly, the amount of the profits or losses, realized or unrealized, by any reader or contributor, from any specific funds or securities.

The author and/or any reader may have experienced materially different performance based upon various factors during the corresponding time periods. To the extent that any portion of the content reflects hypothetical results that were achieved by means of the retroactive application of a back-tested model, such results have inherent limitations, including:

Model results do not reflect the results of actual trading using assets, but were achieved by means of the retroactive application of the referenced models, certain aspects of which may have been designed with the benefit of hindsight

Back-tested performance may not reflect the impact that any material market or economic factors might have had on the use of a trading model if the model had been used during the period to actually manage assets

Actual investment results during the corresponding time periods may have been materially different from those portrayed in the model

Past performance may not be indicative of future results. Therefore, no one should assume that future performance will be profitable, or equal to any corresponding historical index.

The S&P 500 Composite Total Return Index (the "S&P") is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. Standard & Poor's chooses the member companies for the S&P based on market size, liquidity, and industry group representation. Included are the common stocks of industrial, financial, utility, and transportation companies. The S&P is not an index into which an investor can directly invest. The historical S&P performance results (and those of all other indices) are provided exclusively for comparison purposes only, so as to provide general comparative information to assist an individual in determining whether the performance of a specific portfolio or model meets, or continues to meet investment objective(s). The model and indices performance results do not reflect the impact of taxes.

Investing involves risk (even the “safe” kind)! Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of underlying risk. Therefore, do not assume that future performance of any specific investment or investment strategy be suitable for your portfolio or individual situation, will be profitable, equal any historical performance level(s), or prove successful (including the investments and/or investment strategies describe on this site).