Inflation

(The "Silent" Tax)

Often referred to as the "Silent Tax", inflation is the gradual increase of prices over time. It's the opposite of deflation, which is a gradual decrease of prices over time.

Both begin with supply and demand.

Goods and services are produced (supply) and purchased (demand), and money flows between consumers and producers. Naturally, supply and demand fluctuate over time; you don't need a new TV every month, but you need food every day. Inflation occurs when imbalances between production and consumption are sustained for long periods of time.

You can get more detail about the causes of inflation here.

Inflation can show up as increasing prices, increasing costs, or some combination of both. We can also experience inflation because we expect and plan for it. In the end, the inflation you and I experience is a combination of all three types. You can learn more about each type of inflation by clicking this link.

Now, you might be tempted to think inflation is always bad, but that's not the case. If you work hard and get a raise, you just created good inflation (unless it puts you in a higher tax bracket...but that's another web page!). Or, you bought some stock a year ago, and today it's worth more. Also an example of "good" inflation.

Why is it called the "Silent Tax"?

Inflation is considered a tax because it decreases your purchasing power. $1 today doesn't purchase as much as it did 20 years ago. And $1 in the future won't purchase as much as it does today.The "silent" part is because you don't tend to notice it in your daily life, with a few exceptions...like the cost of tuition or a new car.

How is Inflation Measured?

There are two inflation viewpoints:

- Backward looking

- Forward looking

Backward looking inflation is the kind that you hear about in the news. Also called historical inflation, it's the one everyone references when they quote an average rate of inflation. For example, you might hear someone say the cost of living has increased 3% per year, on average, for the past 20 years. In the U.S., the Bureau of Labor Statistics (BLS) collects price information on ~80,000 products/services every month; sort of like looking through advertisements and recording prices every week.

They average these prices together and come up with the "consumer price index" (CPI). The CPI is the governments "official" measurement of how much things cost.

By calculating the change in CPI, the BLS can determine inflation over a given period of time. They actually have a CPI Inflation Calculator on their website, which you can use to determine the change in buying power over time, from present day to 1918.

Click the image to visit the site

The Federal Reserve uses the CPI to figure out if inflation is "too high" or "too low" relative to their target. An inflation target of 2% is gospel when it comes to monetary policy.

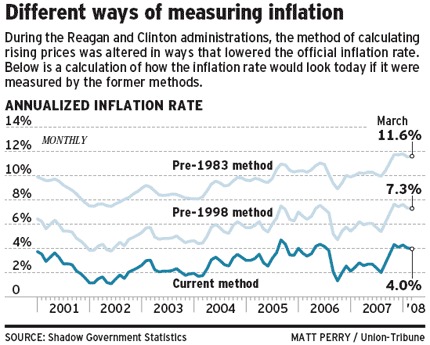

But they're not the only ones. The rate of inflation has a HUGE impact on funding entitlement programs like Social Security and Medicare, retirement contributions, and income taxes. It's this author's opinion that these things have caused the Fed to change its calculation from time to time.

Impact of Government Changes to the Calculation of Inflation

Even without those government "tweaks", there's a lot of disagreement about the products/services used in CPI and whether it's even that useful for its intended purpose in the first place. The make up of our monthly expenses today is different than it was 10 years ago, and will be different in another 10 years. A family of 4 will have a different set of expenses compared to newlyweds or retirees. And each expense will have it's own rate of inflation, and each group will experience that inflation differently.

Forward looking inflation is just an extrapolation of the historical rate into the future. If historical inflation over the past 20 years averaged 3% per year, then someone might assume that it will increase 3% per year for the next 20 years.

The forward looking estimate is primarily used in retirement planning, and it a key variable for determining how much money you'll need. When someone asks you "what's your number", their essentially asking you how big your retirement fund needs to be after you've adjusted for inflation.

How Does Inflation Impact Safe Investing?

Since the government changes the formulas used to calculate CPI to suit their needs, making apples to apples comparisons over long periods of time is difficult. But that doesn't mean you can't or shouldn't try. But the CPI is better than nothing when it comes to estimating your future income needs (e.g. retirement planning).Let's say you plan to retire in 20 years. You sit down with a financial planner and figure out that you'll need $40,000 per year, on average, to cover your expenses. But that number is probably based on what you spend today, which isn't necessarily what you'll spend in 20 years.

But let's assume you'll be spending your money in the exact same way. If the Fed was successful in hitting its 2% inflation target every year, then you could expect your costs to increase that much as well. If that were true, your $40,000 in expenses today would cost you ~$60,000 in 20 years when you start retirement.

And don't forget that expenses would increase by 2% each year after your retirement date. If you retired at 60, and your funds need to last another 30 years, your expenses would reach an annual rate of ~105,000 per year. And your total nest egg would need to be ~$2.4 million dollars.

Only after accounting for inflation can you use something like the 4% rule to estimate the size of your nest egg.

This is just a simple example, but it's one of the reasons controlling expenses is such a critical part of your personal finances. The power of compound interest is great for income and investments, but it can also work against you...this just happens to be one of those scenarios.