Create a Path to Wealth with this Goal Setting Template!

A goal setting template isn't a new idea. Everyone's had to set a goal at one time or another. In fact, I'm absolutely, positively, 100% sure you've used a template before too. Whatever instructions you got, that was a "template"...may not have been a good one, but still a template.Given that there's so much talk about setting goals these days, you'd think it would be easy. There's also a lot of talk about how difficult it is to save, living paycheck to paycheck. So why is it that personal finance and investing goals seem so difficult?

The Problem

Most people use with vague statements as goals, like "I want to be rich" or "I want make enough money to retire". And it's all downhill from there.It's not that these goals aren't "good" or ambitious; they definitely fit those categories. But take a close look at the language.

How do you define "rich"? It's a very subjective statement; being "rich" means different things to different people. Is it money you're after? Maybe it's time?

How do you know when you're rich? Is it based on the size of your checking account or the size of your paycheck? How much of that thing that will make you feel rich do you need? How much do you have today?

What about tomorrow? Twenty-something "rich" is probably a lot different than forty-something "rich".

So what can YOU do to avoid this trap and start being successful right away?

The Solution

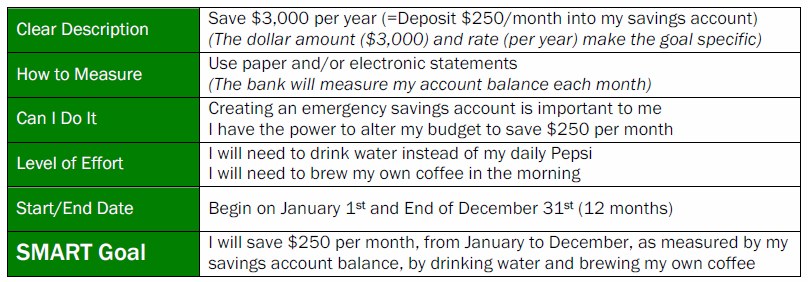

Write it down or print it out, and put it somewhere you'll see it every day. The layout shown below is the one that I used to pay off debt, decrease my expenses, and even create an emergency fund.Because it is based on the concept of SMART goals, it is a great way to clearly define what you want and focus your actions.

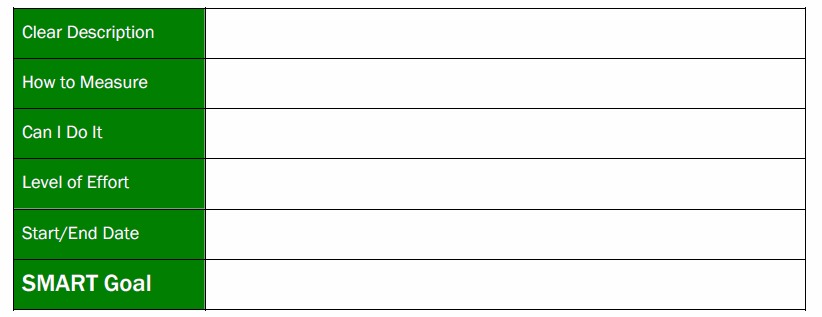

Page 1 contains an example goal, and you can create your SMART Goals on page 2.

P.S. If you're not sure what kind of investing goals to start with, I outlined the personal finance goals I used to start my safe investing journey for you to use an example.