Weekend Stock Market Outlook

Stock Market Outlook For The Week of

September 16th = Uptrend

INDICATORS

20/50 Day Moving Averages: Uptrend

Price & Volume Action: Uptrend

Objective Elliott Wave Analysis: Uptrend

Looks like the stock market opted for a run at new highs, rather than searching for support. A quick run through a bunch of recession indicators (trends in the yield curve, unemployment, new home sales, retail sales, etc.) shows no sign of a recession with the next 12 months. So even if the markets do test support key support levels sometime soon, it's most likely a buy the dip opportunity.

All the indexes start the week above their 20 and 50 day moving averages; the Nasdaq and NYSE regained the 20 day average last week.

2018-09-16 - US Stock Market Averages

A solid week of gains on rising trading volume last week; not quite as much volume as expected, but we're in a positive position nonetheless.

OEW is still in an uptrend, and still expecting new highs in all market averages before any kind of next major correction.

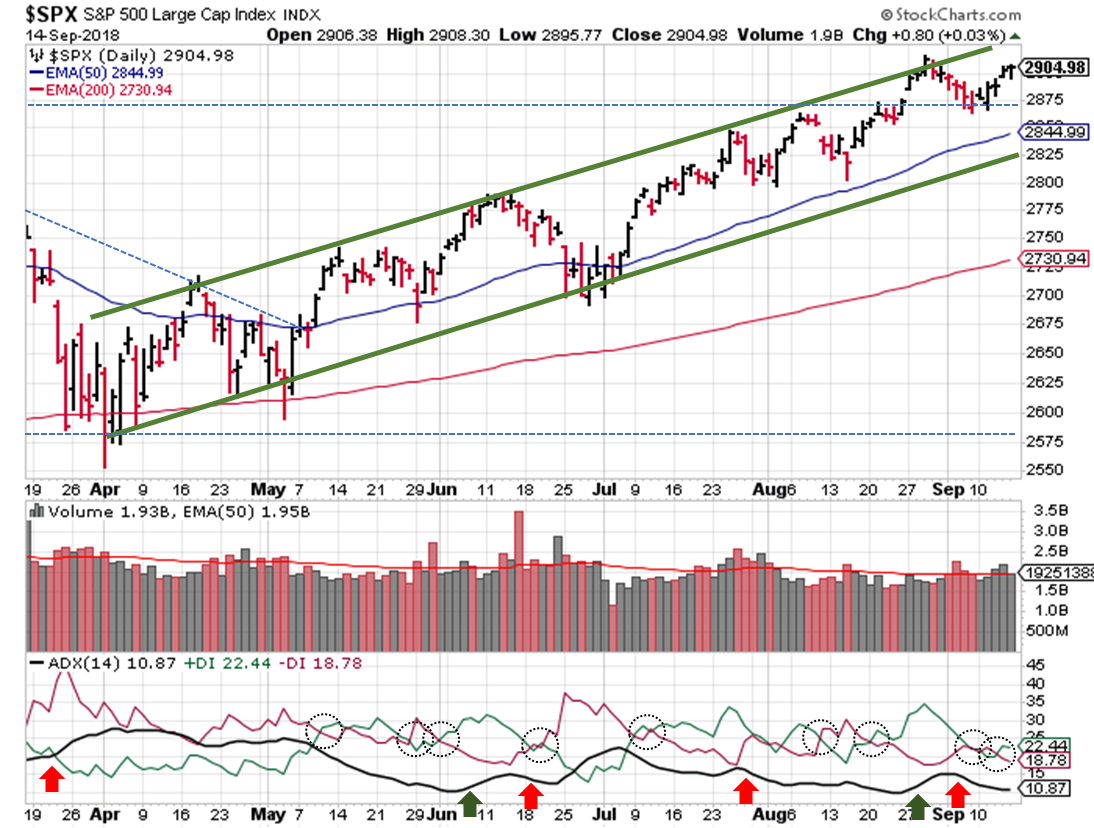

2018-09-16 - SPX Technical Analysis - Daily

The S&P ($SPX) starts the week in a good position; fresh off a key support level and in the middle of our price channel. Tell me if you've heard this one before: the ADX is showing a weak trend. At least the directional indicators are supporting of an uptrend (DI+ is greater than DI-). One of these days I'll find a momentum indicator to supplement the ADX.

2018-09-16 - SPX Technical Analysis - Weekly

Extending our view, we see the expected increase in trading volume, and the January high acting as a support level last week.

And since we've successfully recovered the January high, it's a good time to check your asset allocation levels and/or take some profits. Remember: bulls make money, bears make money, pigs get slaughtered.

If you find this research helpful, please tell a friend. If you don't find it helpful, tell an enemy. I share articles and other news of interest via Twitter; you can follow me @investsafely. The weekly market outlook is also posted on Facebook and Linkedin.

You can check out how well (or poorly) the outlook has performed as a stand-alone, signal generator using past performance estimates:

- 2015 Performance - Stock Market Outlook

- 2016 Performance - Stock Market Outlook

- 2017 Performance - Stock Market Outlook

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of stockcharts.com.