Grow your income and reduce expenses with a personal income statement

Did you know that simply creating a personal income statement can save you money?That's right! Simply tracking your income and expenses each month can quickly help you save more money.

But wait! There's more!

What if I told you that not only will it save you money by reducing monthly expenses, but being disciplined about your income and expenses can actually make you more money?

Interested? I thought so!

True Story

Growing up, I was always good with money; I loved filling up my piggy bank. I would make like piles all over the floor; counting and recounting for hours.When I went off to college, I kept making tiny deposits into my savings account, balanced my checkbook, avoided bouncing checks, and didn't carry credit card balances.

After graduating from college, I got a real job. And at first, it was all good. I suddenly had money to spend! But along with that real job came real bills. In what seemed like an instant, I went from feeling rich to wondering what happened to my money every month. It was there...then it wasn't.

Honestly, it made me angry that I didn't have control over my money. I was working hard, and had little to show for it. And I knew that if I couldn't handle the money I did have, I would never be able to handle the large amount of money I wanted.

Enter Robert Kiyosaki and the concept of a personal income statement.

I learned that in order to manage my money, I needed to understand how it flowed into, and then out of, my hands. The personal income statement showed me how much money I had coming in, and how much money was going out.

At that time, it should have been called a personal expense statement! Once I saw all my expenses (and recovered from the initial shock), I began working on lowering them as much as possible.

If you stick with it, you'll end up saving yourself a lot of money, which is one of the main goals of having a personal income statement.

Safe Investing Tip:

Need an example of a personal income statement?

Click here to open a new window with your FREE template

(right click/save as to download the pdf)

What is a Personal Income Statement?

It's actually very similar to a corporate income statement (also called a Profit and Loss (P&L) Statement or a Statement of Operations), and can be captured by the following equation:Revenue - Expenses = Income

"Income" is the amount of money you make (Revenue) minus the amount of money you spend (Expenses). This is why we call it an "Income Statement".

A word about "revenue": according to Robert Kiyosaki, assets generate revenue. For example, when you have a job, you are an asset to a company because you do things that make the company money...otherwise you won't be an asset for long!

And you got a job because of your knowledge and skills, so those are your personal assets. And those assets determine your value to the company (i.e. what they are willing to pay you).

Most people use the words in reverse; "income" to describe how much they make ("revenue"), and the word "profit" to describe how much they keep ("income"). In this case, the equation above looks more like this:

Income - Expenses = Profit

I provide a free template as an example (PDF) rather than something editable, to force you to go through the exercise of creating a system that you are comfortable using!

Remember, it's called personal finance for a reason, and the personal income statement is no exception. The goal is to help YOU get comfortable with your finances, so change the groups and categories as needed for your needs and understanding.

This is one of the reasons investing is so challenging in the beginning; people use different terms to describe the same thing. To keep things simple, I'll talk about the income and expenses from here on out.

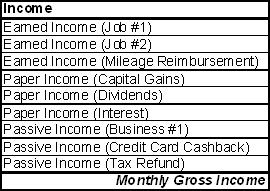

Income

The most important part of your personal income statement is income. Without income, there is no money for investing, safe or otherwise.This is also the section where personal income statements help you make money.

After creating my first statement, I saw that I had one source of income (my job), and almost 40 different expenses.

It was as this point I committed myself to finding additional sources of income.

Think about it. If your company only had one customer, and that customer left, you'd go bankrupt. Why should the business of you be any different?

Personal income is classified into 3 different forms: Earned, Paper or Portfolio, and Passive. You should try to develop a mix of all of them.

I group income just like the IRS does in the tax code. Using their rules helps save time when you get things ready for tax season.

The IRS takes a portion of all your personal income via taxes, but the amount they take is different depending on the group. So knowing which type of income you have is important in order to pay the right amount of taxes and avoid an audits.

Earned Income

Earned income is the kind that you receive as an employee. Usually, this payment is in the form of a paycheck. It is called "earned" because you receive it in exchange for the value you create from effort or labor.

YOU ARE NOT PAID FOR YOUR TIME!

If you were, you would be paid for just for showing up at your job. Instead, time is just a convenient and standard way to capture the amount of labor you perform.

But time does not capture the value of your labor. Value is reason that two people can both work 40 hours and get paid different salaries.

Getting paid for value, rather than time, is an important distinction. This means that you can only create income when you are creating value...keep this in mind when you're thinking about ways to generate passive income.

Advantages of Earned Income:

- Payments are predictable and consistent

- Employers "pay" for your mistakes

- When you make a mistake at work, your paycheck usually isn't decreased

Disadvantages of Earned Income:

- Conditional (no job = no income)

- Most highly taxed form of income

- Federal, State, Social Security, Medicare

- When you get a raise, so does the government

- Only a few personal expenses can be subtracted "pre-tax" (Retirement Plan, Health Insurance)

- Labor has no residual value

- This means that extra effort one day does not carry over to the next...there is ALWAYS more to do!

The next time you receive a paycheck, look at how much of your hard earned money is removed before you get anything...

Paper Income

Portfolio and/or "paper" income is generated by paper assets that you hold in your investment portfolio (stocks, bonds, and other financial investments). So portfolio (paper) income is created by your trading and investing process.

Advantages of Paper Income:

- Fewer taxes than earned income

- You can use other people's time (research/data) and money (leveraged investments or margin trading accounts)

- You control where and when you invest your time/money

Disadvantages of Paper Income:

- Payments are not as consistent as earned income

- You end up paying for errors and mistakes

- 3 different tax rates

- Long Term Capital Gains, Short Term Capital Gains, and Dividend Taxes

Passive Income

Passive income is the best type of income, but also requires the most time to create.

With earned income, you start getting paid almost immediately. With paper income, you get "paid" when you sell something, which could be short or long term. When it comes to passive income, you may not make any money for quite some time (years!). It is definitely not a "get rich quick" idea.

But...once you've created a passive income stream, it requires little effort to maintain (which is the reason that everyone wants it).

Some people say dividends and interest payments are also passive income because these two types of paper income require almost no effort to maintain. But since the IRS classifies both as portfolio income, that's where I put them so that calculating my tax returns was easier.

Advantages of Passive Income:

- Residual Value

- After creation, passive income can be produced with little or no effort

Disadvantages of Passive Income:

- Requires a large amount of time and effort, without any guarantee on the size of the income stream

Expenses

Expenses are things that you spend your money on. And as everyone knows, there are (too) many different ways to create them.For example, buying an asset can create expenses. When you buy a stock, money leaves your trading account and in return, you get an asset.

Recurring expenses (those that you pay on a monthly basis) are usually created by liabilities, such as a mortgage or a student loan.also create expenses, such as a mortgage, student loan, and other forms of debt.

Assets and liabilities show up in a different personal financial statement, called a balance sheet.

You can learn more about assets and liabilities on my personal balance sheet page.

Your first personal income statement will probably seem more like a personal expense statement! But this is normal. Once you identify and remove the problem areas (i.e. those negative cashflows), you can focus on increasing your sources of income.

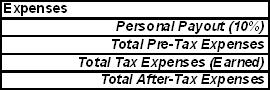

Generally speaking, you can lump your expenses into the following categories:

- Personal Payout

- Pre-Tax Expenses

- Taxes

- After-Tax Expenses

I go an extra step and split After-Tax expenses into "Escrow", "Living", and "Miscellaneous". This separation makes seeing the problem areas easier.

I use categories that make sense to me, because I'm the one making the decisions. You should definitely do the same when creating your version of the personal income statement.

Personal Payout Expense

As mentioned on my personal financial goals page (click here), you should pay yourself before doing anything else with your paycheck.

Technically, your company removes taxes before you get your paycheck, so how can you pay yourself first?

Good question. I pay myself first by setting up an automatic, 10% withdrawal of my monthly, pre-tax income. Pre-tax income is the amount I earned BEFORE taxes (called your gross income).

This is an important, symbolic action on your part. By placing this expense first (I worked my way up from 0% to 10% over a multi-year period), you are ensuring that you are the first person rewarded for your hard work.

And it also makes personal budgeting a little easier!

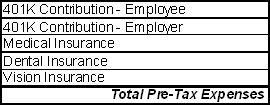

Pre-Tax Expenses

Pre-tax expenses are payments that you make before taxes are removed.

These expenses are usually removed automatically from your paycheck before you get your hands on it, and include items such as health insurance deductions and your retirement plan contributions (401k).

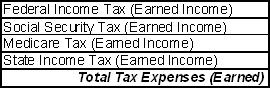

Taxes

In this category, you track the taxes you pay each month. These expenses are listed as "deductions" on your paycheck and show up as large, negative numbers.

The following list contains common phrases used to describe the different taxes.

You probably noticed that all of these expenses are related to earned income. I structured it this way because employee's don't have a choice whether they pay taxes.

After-Tax Expenses

Once you've paid yourself and the government, the rest of your paycheck is yours to spend. And more than likely, most of the remainder is already spent each month! Time to figure out where the rest of your money is going.

Usually, after-tax expenses are the most out of control area of a personal income statement. The irony is that this category is the one that you have the most control over.

After-tax expenses get away from everyone, simply because there are so many different ways to spend our money. Discipline is a MUST when it comes to tracking after-tax expenses accurately.

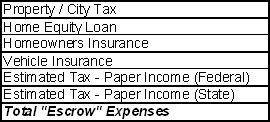

"Escrow" Expenses

Many of you have heard of an escrow account, especially those of you interested in home ownership. Basically, this type of account is created by your mortgage company to make sure you pay your bills.

Each month, you write a check to the mortgage company, and they deposit a portion of that check into a savings account with your name on it. Unfortunately, you don't have access to this money; the bank does.

The bank earns interest on your money, in return for automatically paying expenses like your homeowners insurance and property taxes.

Safe Investing Tip:

If you can, create your own "escrow" account by opening a savings account for yourself and put your "escrow" expenses in it every month. You'll be the one earning interest, not the bank!

I created my own "escrow" account, so that I was the one earning interest. I like the idea so much that I expanded my account to include all my annual and semi-annual bills...even my year end donations to charity!

To set up your own "escrow" account, figure out which expenses you MUST pay each year (such as taxes and insurance). Here is an example list of expenses that could qualify:

Divide each amount by 12. This is your monthly payment.

Then, go to a bank and set-up a new account (an online account works well in this case). Create an automatic, recurring monthly deposit for each expense, every month. Now you're making paper income (interest), just for having the discipline to plan ahead!

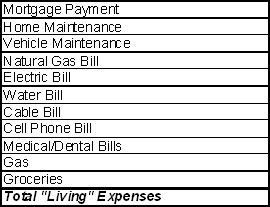

Living Expenses

"Living expenses" are the payments that you make for food, water, and shelter. Without these three things, none of us would live very long.

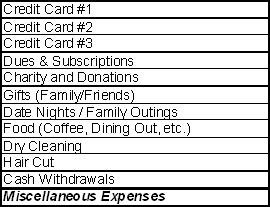

Miscellaneous Expenses

This is pretty much an open ended category. It was the hardest part of creating a generic personal income statement because everyone spends money differently.

The actual title of each row isn't important. What's important is that you organize it in a way that tracks ALL your remaining expenses.

Be careful not to penalize yourself by double counting expenses. If you use your credit card to pay bills (automated charges to your credit cards), be sure to subtract that amount if you're tracking it somewhere else. For example, I made this mistake when tracking how much I spent on gas.

The last entry (cash withdrawals) is EXTREMELY important. This is where I saw the biggest area for improvement in my personal income statement. It is too easy to lose track of debit card transactions and ATM receipts.

Even if your personal income statement is perfect up to this point, you could still find yourself living from paycheck to paycheck because of this expense alone.