Weekend Stock Market Outlook

Stock Market Outlook For The Week of

August 6th = Uptrend

INDICATORS

20/50 Day Moving Averages: Uptrend

Price & Volume Action: Uptrend

Objective Elliott Wave Analysis: Uptrend

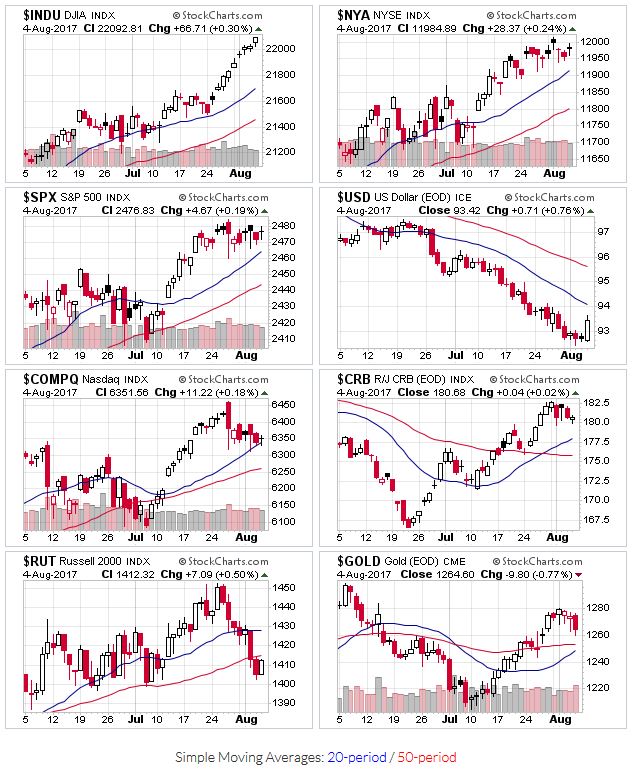

A strange week: The DJIA sits at all time highs, the S&P500 moved sideways, the Nasdaq fell to a support level, and the Russell 2000 entered a downtrend(!). Over the past two weeks, the Dow has been on a tear, with 9 higher closes and 8 at all time highs.

Except for the Russell 2000, all the major indexes remain above their 20 and 50 day moving averages.

2017-08-06-US Stock Market Averages

No change in the price/volume indicator...still in an uptrend.

OEW remains in an uptrend, with an eye on the 2478 level on the S&P500.

Recent earnings announcements have been make or break for growth stocks, causing prices to gap up or down during after hours/pre-open trading. Even positive results are not enough to guarantee a positive price move, as companies have beat earnings estimates, but not by a wide enough margin, and then sold off. This makes investing a bit more risky. You have to hold a position going into the market close, which is not a big deal for longer term holdings, but makes new positions and/or set-ups difficult to manage. This is why proper position sizing is so important...sell as soon as the position moves against you and keep your losses small!

If you find this research helpful, please tell a friend. I share articles and other news of interest via Twitter; you can follow me @investsafely. The weekly market outlook is also posted on Facebook and Linkedin.

You can check out how well (or poorly) the outlook has tracked the market using past performance estimates:

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of stockcharts.com.