Weekend Stock Market Outlook

Stock Market Outlook For The Week of

July 23rd= Uptrend

INDICATORS

20/50 Day Moving Averages: Uptrend

Price & Volume Action: Uptrend

Objective Elliott Wave Analysis: Uptrend

A solid week of gains puts all three signals back in the green. Trading volume is still a bit low, and may remain so until September.

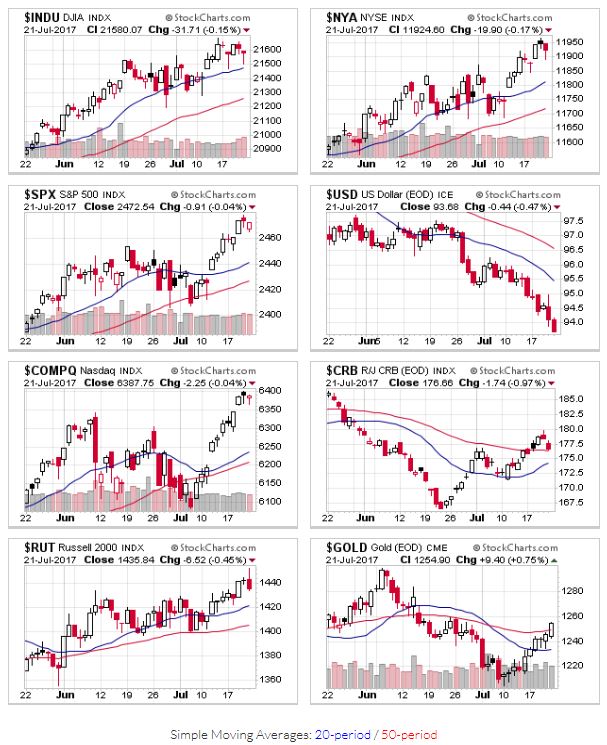

The markets have staged a nice rally from their near-term lows 2.5 weeks ago; the NASDAQ had led us lower...now it has rallied ~5%! All the major indexes are now well above their 20 and 50 day moving averages. It's worth noting that Commodities (including gold) have reached uptrend territory, while the USD continues to fall.

2017-07-23-US Stock Market Averages

As mentioned last time, a strong week of trading and a few more distribution days outside the 20 day window has put the price/volume signal back in uptrend mode.

OEW is still looking for confirmation that the former rally is extending, or if this is just a really strong bounce in what is a new correction. Either way, the uptrend signal remains in place.

If you find this research helpful, please tell a friend. I share articles and other news of interest via Twitter; you can follow me @investsafely. The weekly market outlook is also posted on Facebook and Linkedin.

You can check out how well (or poorly) the outlook has tracked the market using past performance estimates:

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of stockcharts.com.