Use Personal Budgeting to Achieve Your Financial Goals!

Here's the secret to personal budgeting: don't spend more than you make.I know it sounds simple, but it's just like everything else in this world; if it were easy, everyone would do it. You don't need to look any further than the global economy. The issues we've faced since 2008 are a direct result of our collective inability to save more than we spend.

Instead, we borrowed without much concern for the future consequences.

In the US, we have a debt clock. It keeps track of how much debt we have...we actually built something to measure how terrible we are at managing money!

Sadly, most Americans follow in our governments footsteps. Many families spend more than they earn, using credit cards and home equity loans to finance their lifestyles. Like it or not, at some point, we will have to pay off our debts (as a nation and as individuals).

What is Personal Budgeting?

You've probably grown tired of hearing about all the "normal" advice when it comes to budgets: you should spend less than you earn, you should live below your means, you should save more, you should yada, yada, yada.That is why I have a slightly different take on personal budgeting. From a safe investing perspective, personal budgeting is not really about how much you spend. Rather, it is about what you spend your money on.

The only way to invest (safely or otherwise) is to spend a portion of your monthly income on investments. And the best way to make sure that you have money left over at the end of the month is through personal budgeting.

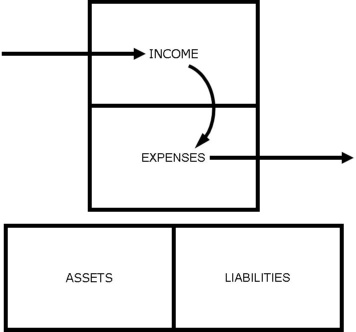

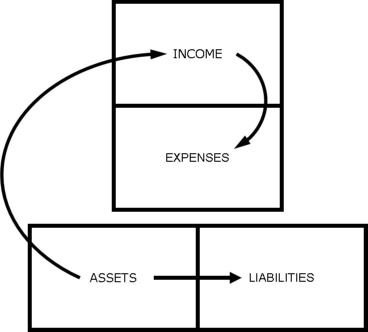

I take this viewpoint because personal budgeting is the ONLY way you will move from the cashflow pattern of the poor to the cashflow pattern of the wealthy. And having your investments pay for your future expenses is exactly what you must do if you're going to have any chance at a so-called "traditional" retirement.

Poor Financial Health vs. Financial Independence

Part 1) Manage your expenses to break-even each month (Income = Expenses)

Part 2) Manage your income and expenses to create a profit (Income > Expenses)

Part 3) Manage your profits

These steps won't happen without some effort on your part.

You MUST know how much you make and spend. You can do this on an annual basis or a monthly basis; the choice is yours. My experience is that seeing progress is easier if you do things per month. And the added detail allows you to plan ahead for months that are more difficult financially, such as the winter holidays.

Click here to download a template for creating your own personal income statement.

Part 1) Personal Budgeting for Breaking-Even

At this point, I'm assuming that you've got your income and expenses modeled for at least 12 months. It is okay if you don't, but my examples are based on a full year's worth of historical data. If you've never charted your income and expenses before, you're probably a little discouraged right about now. Don't be; you're actually in a position of power now. You can make changes.In part 1, you need to take an honest look at where you're spending your money. You've probably never looked at this before. You've probably just got a large entry that says "Cash" or "Cash Withdrawals" or "ATM" or "Weekly Allowance". It is just a slush fund because you've been lazy about tracking your money. How do I know? Because I had one...and it was because I was too lazy to deal with it.

That is not to say that cash is bad. Actually, it is a great tool for this first step. You should be paying for as much as possible by cash or check. This will force you to actually hand over the money physically...and this will make a big differnece because money leaving your hands makes it up front - no longer out of sight out of mind.

It is also important to get in the habit of knowing what money goes where, so you can automate payments later on in your journey and not have to worry about it.

At this point, you want to identify two things:

- How much money you need to stop spending in order to break-even. I purposely did not use the word "save" because until you are breaking even, you're spending money that you don't have, making "saving" impossible.

- You largest single "personal" expense. By personal, I mean ones that you create. Taxes are a huge chunk, but they are the price you pay for being employed and not something to worry about when you're trying to break-even. Mortgage/rent payments are also fairly large, but you need a place to live. No, you want to focus things like the amount of money you spend on coffee every week, going out to lunch at the office, or the data plan for your cell phone.

Pick one and figure out a way to reduce it. Maybe it is brown-bagging your lunch a few days a week, cutting back on the data plan (or ditching it all together), or buying a thermos and bringing a bunch of coffee to the office.

If the improvement was enough for you to break-even, AWESOME. Keep doing it for 3 months. If you can make it through three months, then you're almost ready to begin Round 2.

Ask yourself: Are there any trade-offs I need to make in order to achieve my other financial goals?

Again, this relates to what is achievable, realistic, and timely. You may need to delay that new car in order to create your 6 month emergency fund. Or, you may need to increase your 6 month emergency fund because you just bought a new car and now your monthly cash-flows have changed.

Part 2) Personal Budgeting for Profit

Now that you've broken even, you know you have what it takes to control an expense. It's time to take it to the next level. You're job now is to get them all under control. This may mean making some trade-offs on your part. Is the lease on a new car every 2 years really worth it?For me, grocery shopping was a rather large expense. I have a healthy diet (and by healthy I mean fruits and vegetables) which isn't cheap. So I started shopping for my produce at a different store with better prices. The increased in cost for gas to drive the extra few miles was more than offset by the savings on food.

Remember that at this stage, your big purchases aren't really yours...they're your banks. Breaking even means that you don't have a lot of money available for expenses, and anything large probably involved borrowing of some kind.

The goal here is to have extra money left over at the end of the month. Those of you who work hard can get to a place where you'll not only be paying yourself first each month, but you'll also have money left over. When that happens, you're almost ready to start investing.

Ask yourself: Are my goals still S.M.A.R.T.?

During this step is when you'll begin to lay out your personal financial goals...the ones that you'll need to achieve before you start investing. If you need some tips, check out my page on personal financial goals. More than likely, any goals you've set (at least financially) will need to be updated a little, now that you have a better understanding of your personal finances. Maybe your goal was to be a millionaire next year...now it might take 2!

Part 3) Making your Money Work Hard for You!

Ok. You've mastered your expenses. You're starting to have money left over at the end of each month. Now what?Now it is time to start investing safely.

Ask yourself: Is it time to find an advisor?

Have everything under control? Do you want to make plans for things beyond 5 years? This is a great time to contact an advisor. They will be in a great position to help you choose between all the different options.

With your personal financial statements and personal budget in hand, you will be in a great position to pick the right option (i.e. one that YOU are comfortable with and fits YOUR goals).