Find the Best Financial Investment Advice Fast

Looking for financial investment advice does NOT have to be scary, frustrating, or confusing. While the internet and social media have made it really easy for anyone to share their opinion, it also easy for "real" personal financial advisors to do the same.A personal financial advisor is a financial professional who is paid to provide customized financial investment advice, based on your unique set of circumstances. That said, we're still talking about a very broad category, which covers many different backgrounds, certifications, and degrees.

You've probably heard of a few: MBA, JD, CPA, CFP. But what about an "Accredited Financial Counselor", or a "Chartered Financial Consultant"? You've probably never heard of either of them, let alone know the differences between the two. How can anyone know who's the "right" choice?

Fear not...read on.

What Kind of Financial Investment Advisor is Right for Me?

There are three main types of financial investment advisors: Fee-only, Fee-based, and Commission-based.-

"Fee-Only" financial advisors are service providers. They only get paid by when they provide you with a service. They're like consultants, in that you usually pay them for their time (i.e. an hourly rate). It could be for something as simple as reviewing your portfolio and providing recommendations, or helping you with tax and estate planning. This type of advisor doesn't get anything (commissions, discounts, other incentives, etc.) if you purchase financial products from them (e.g. a mutual fund or ETF).

"Fee-based" financial advisors are similar to fee-only advisors, with one important distinction. While a majority of their revenue comes from client fees, a small part of their income can come from selling financial products, either from a brokerage, mutual fund, or insurance company.

"Commission-based" advisors are compensated when you them. a percentage of the amount you choose to spend or size of the portfolio they manage. There are potential conflicts of interest because they make money when you buy something, regardless of whether or not it is a good “fit” for your situation.

The key distinction between these advisors is whether they have fiduciary responsibility. In other words, are they legally required to put your best interest first? Are they legally required to disclose conflicts of interest, like earning commissions from products they sell?

A fiduciary can't sell you something that doesn't fit your needs, goals, and/or risk tolerance, or you could sue them. They have a legal responsibility to you, their client, to disclose conflicts of interest (like earnings commissions on products they sell you).

Fee-only advisors are fiduciaries. Fee-based advisors usually are fiduciaries, but don't have to be. Commission-based advisors usually aren't fiduciaries, but can be.

Where to Find Financial Investment Advice

The best place to start your search is with the National Association of Personal Financial Advisors (NAPFA).NAPFA is an American trade organization, created for fee-only advisors. Their mission, as stated on their website, is:

- "To promote the public interest by advancing the financial planning profession and supporting our members consistent with our core values."

In order to be a member of NAPFA, personal financial advisors and investment specialists must meet a strict set of professional standards. This is done through the process of peer reviews for a potential candidate’s work (e.g. comprehensive financial plan for a client).

A "comprehensive" plan must meet the common needs of many individuals and families, including:

- Goals and objectives

- Visit our page on personal finance goals

- Learn how to create SMART goals and objectives

- Net worth statement

- Determine your net worth using a personal balance sheet

- Cash flow analysis

- Learn about organizing personal finances using cashflow diagrams

- Recent tax return and analysis

- Insurance needs

- Auto, home, life, medical, short/long term disability, umbrella, etc.

- Investment analysis and recommendations

- Retirement needs and projections

- Estate plan

- Living will, living proxy, durable power of attorney, etc.

NOTE: You can start improving your financial future right now by clicking on the links next to each bullet point. Save time by preparing before a meeting, so you can spend time on specific questions rather than rehashing your basic info!

As you can guess, the strict criteria keeps membership small (~2400 members as of the creation of this page). But these standards work in your favor.

NAPFA members have a reputation for excellence and integrity, which is hard to come by, as seen during the 2008 financial crisis.

The site has a simple interface for you to use in your search.

The National Association of Personal Financial Advisors Website

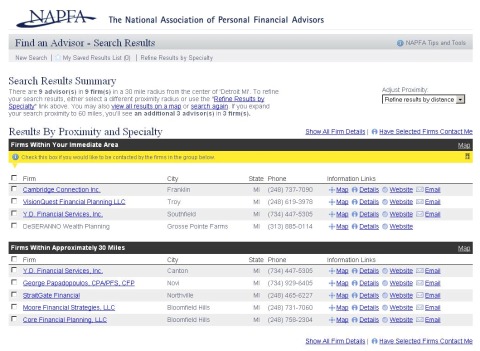

After entering your home town or zip code, a list of local NAPFA members will appear. You can also search for a specific advisor to see if he or she is listed.

Along with a phone number, the results include a map of the address, a short description for the advisor, a link to the advisor's website, and email address if available.

NAPFA Search Results - Detroit, Mi

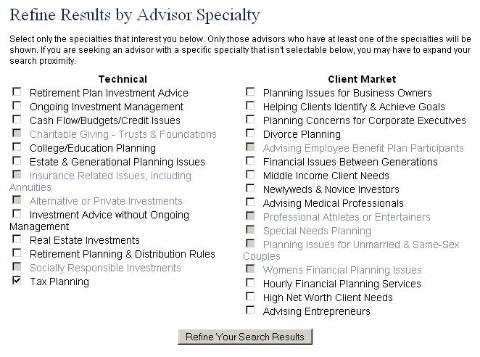

The "Refine Results" option is the best feature of the site. By following the link, you can select the specific specialties you need, including:

- Retirement Plan Investment Advice

- Ongoing Investment Management

- Cash Flow/Budgets/Credit Issues

- Charitable Giving - Trusts & Foundations

- College/Education Planning

- Estate & Generational Planning Issues

- Insurance Related Issues, including Annuities

- Alternative or Private Investments

- Investment Advice without Ongoing Management

- Real Estate Investments

- Retirement Planning & Distribution Rules

- Socially Responsible Investments

- Tax Planning

- Planning Issues for Business Owners

- Helping Clients Identify & Achieve Goals

- Planning Concerns for Corporate Executives

- Divorce Planning

- Advising Employee Benefit Plan Participants

- Financial Issues Between Generations

- Middle Income Client Needs

- Newlyweds & Novice Investors

- Advising Medical Professionals

- Professional Athletes or Entertainers

- Special Needs Planning

- Planning Issues for Unmarried & Same-Sex Couples

- Womens Financial Planning Issues

- Hourly Financial Planning Services

- High Net Worth Client Needs

- Advising Entrepreneurs

Refining Your Search Results

Why Pay for Financial Investment Advice?

As I mentioned at the top, there's no shortage of people providing advice on the internet (this site included!). And while it's great to use these resources to get started, it makes sense to pay someone for financial investment advice when you have specific needs or questions that are unique to your situation.For example, you've done everything you can with this site, learned all about creating your process and have some things on autopilot, but you're concerned about how it will impact your taxes.

Or, maybe you're nearing retirement, and you need some advice on how to pay for medical or life insurance using your retirement accounts. In both those cases, it's time to seek out some advice.

It is also appropriate to seek out financial investment advice when you care about your money (Rule Number 1), but are wise enough to know you can't or don't want to do it on your own.

Factors Affecting Cost

The cost of your financial investment advice will depend on what services you need. Complicated estate planning or structuring a corporation will usually cost more than having someone look over your taxes.Keep an eye out for "hidden" fees and any payment quoted in percentages. 1% or 2% does not seem like a lot, but as your account grows, the annual commission you're charged also increases.