Weekend Stock Market Outlook

Stock Market Outlook For The Week of

September 25th = Mixed

INDICATORS

20/50/200 Day Moving Averages: Mixed

Price & Volume Action: Uptrend

Objective Elliott Wave Analysis: Uptrend

As expected, another volatile week for US stocks. The Fed's decision not to raise interest rates led to a rally, most notably in the tech/small cap sectors. The markets aren't out of the woods yet, so the outlook remains mixed, but a strong showing this week will prompt a change in market outlook.

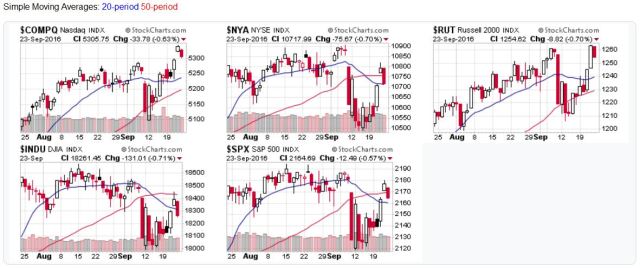

The Nasdaq and Russell 2000 are leading the way, with both indexes above their 20, 50, and 200 day moving averages. The NYSE/S&P500 are above their 20 day moving averages, but not their 50's, reflecting the recent sell-off. The DJIA ended last week below both its 20 and 50 day moving averages. Since 3 of the 5 indexes closed below their 50-day, the outlook remains mixed from a moving average perspective.

2016-09-25-US Stock Market Averages

No distribution day this Friday (except for the DJIA) as trading volume subsided verses Thursday. And positive price/volume action on Wednesday and Thursday signaled that the uptrend is back. That said, the count remains elevated, so a relatively small amount of institutional selling could derail the new uptrend.OEW increased the odds of an uptrend to 80% (Weekend Update). As mentioned last week, this also means that the recent correction was the smallest in the last 10 years. My hypothesis is a combination of quantitative easing and high frequency trading are increasing the magnitude and shortening the duration of sell-offs.

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of StockCharts.com.