Weekend Stock Market Outlook

Stock Market Outlook For The Week of

August 21st= Uptrend

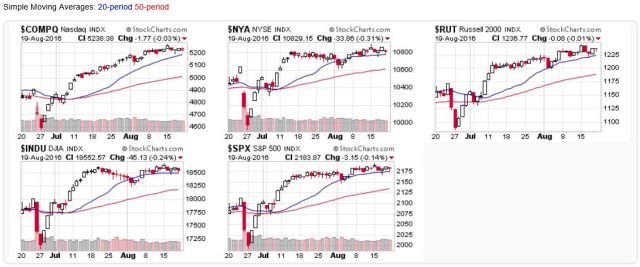

MOVING AVERAGES

Short-term (20 DMA): Uptrend

All the major stock market averages remained above their 20-day moving averages.

Intermediate (50 DMA): Uptrend

All the major stock market averages remained above their 50-day moving averages.

Long-term (200 DMA): Uptrend

All the major stock market averages remained above their 200-day moving averages.

2016-08-21-US Stock Market Averages

COMMENTARYUS stock markets continued to move sideways last week...a bit surprising given that Friday was an option expiration day.

All indexes remain above their moving averages. Price/volume action is okay...not too many distribution days, and a lot of stocks digesting recent gains. OEW analysis suggests a 5% correction is likely near-term (Weekend Update).

When leading stocks are extended, remember to watch your holdings. Check your sell rules and consider taking some profits if you've hit your targets. One example could be selling half your position if the stock is up 20% or more during the current rally.

The Fed's annual gathering in Jackson Hole is this week (Thursday / Friday), which could create some volatility for those traders with itchy trigger fingers.

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of StockCharts.com.

Moving Average Signals:

Uptrend = Market indexes remained above their moving average during the trading week

Downtrend = Market indexes remained below their moving average during the trading week

Buy signal = Market indexes rose above their moving averages during the trading week

Sell signal = Market indexes fell below their moving averages during the trading week