Stock Market Outlook - Jan 31, 2016

Stock Market Outlook entering the Week of January 31st = Downtrend

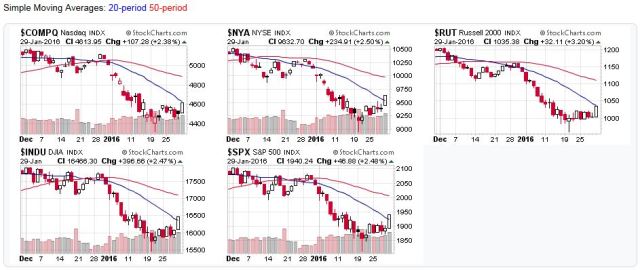

MOVING AVERAGES

Short-term (20 DMA): Mixed

3 of the 5 major stock market averages rose above their 20-day moving averages.

Intermediate (50 DMA): Downtrend

All the major stock market averages remained below their 50-day moving averages.

Long-term (200 DMA): Downtrend

All the major stock market averages remained below their 200-day moving averages.

2016-01-31 - US Stock Market Averages

COMMENTARYFriday's positive price action helped US equities reclaim some ground (e.g. the 20-day moving average). As expected, the near-term bottom referenced in last week's outlook held firm and we got our short-term rally. Going forward, there are a lot of global economic factors making institutional buyers cautious, so individuals should do the same.

Price/volume action waffled last week, with volumes supporting an uptrend one day, then rising even higher as markets sold off the next. Combined with an OEW call for a new bear market, expect any rally to be short-lived and use it as an opportunity to sell, "bearify" your portfolio (e.g. shorting, buying put options, selling covered calls) or just selling your positions and sitting on the sidelines until conditions improve.

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro.Charts courtesy of StockCharts.com.

Moving Average Signals:

Uptrend = Market indexes remained above their moving average during the trading week

Downtrend = Market indexes remained below their moving average during the trading week

Buy signal = Market indexes rose above their moving averages during the trading week

Sell signal = Market indexes fell below their moving averages during the trading week