Dollar Cost Averaging: The Good and the Bad

Dollar cost averaging is a technique that some investors use to figure out how much money to invest. You usually here about it when you're talking to a financial advisor about saving for retirement.

In fact, you probably already do it already and don't even know it!

Dollar cost averaging is applied when you'll be constantly adding to your investments. Actually, this is what happens if you have a retirement account at work and you set up "ongoing contributions".

What is Dollar Cost Averaging

The phrase actually refers to how you calculate the starting price of your position in a particular stock. You take all the prices that you paid for each share, and average them together. The result is your dollar cost average share price.

To get an average share price, all you need to do is to use the same amount of money on a repeat basis (usually once a month). For example, each month you might buy $1,000 worth of Johnson & Johnson stock.

The key assumption is that you have already picked out the investments you want to buy, and you're just going to continue to by more shares no matter what. This is the meaning of "ongoing contributions".

It is the "no matter what" part that can cause you some trouble. It means that investing each month is more important that the price you pay. In other words, you don't care whether the stock is rising or falling in price; whether the market is in a confirmed uptrend or a correction.

If prices are high, then your set investment amount will buy fewer shares. If prices are low, then your set investment amount will buy more shares.

This is different from buying a stock several times and averaging the prices you paid. You will have an "average" buy price, but you are not continually investing the same amount of money, over and over again.

How Does Dollar Cost Averaging Work

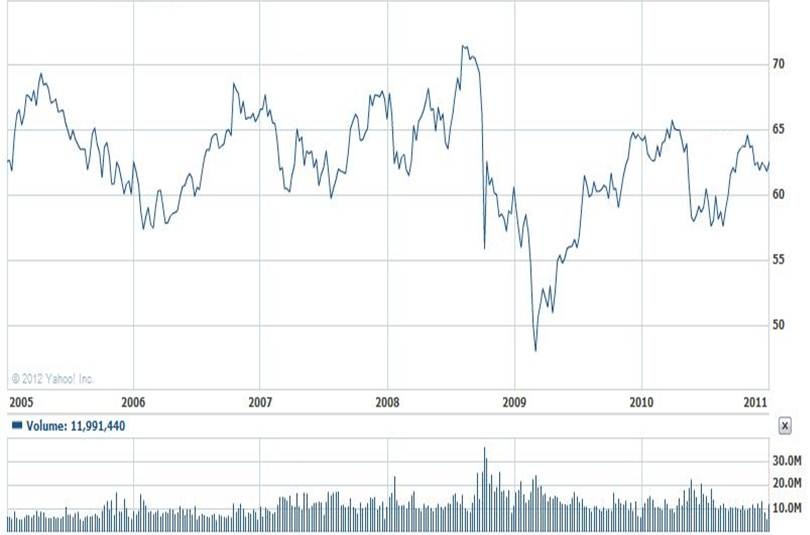

As an example, lets assume that back at the start of 2005, you met all your personal finance goals, and you have $100 left at the end of each month to invest. And lets also assume that you decided to invest that $100 in Johnson & Johnson stock each and every month for 5 years (until December 2010).

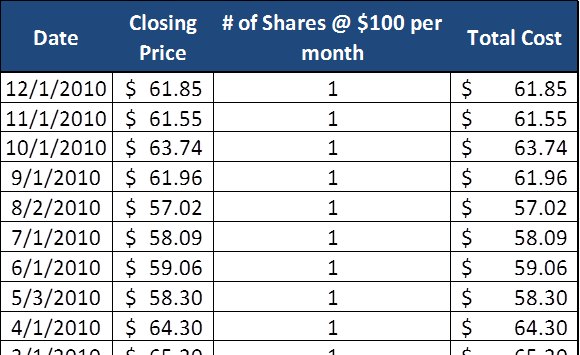

Click on the picture to see a screenshot of the entire table

If we add all your monthly stock purchases together, you would own 73 shares of JNJ stock over 5 years, at a total cost of $4,540.76. This results in a dollar-cost averaged share price of $62.20 ($4,540.76 / 73).

Advantages

The main advantage is that you can potentially lower the average cost of your shares. So when you calculate your profit (average sell price - average buy price / average buy price), your average buy price will be "low", and your resulting profit will be "high".

Disadvantages

The main disadvantage is that you have to invest when prices are falling in order to lower your average cost of your shares. This is called putting good money after bad. After all, when the stock price is falling, you are buy a stock that is losing money.

You cannot limit losses if you are investing in a stock that is losing money.

There is another problem. If you are practicing position sizing, your position is changing each time you add money. This will change the level of risk that you used to calculate your initial position size, which is bad.

Is Dollar Cost Averaging Right for You?

This tactic DOES NOT guarantee you'll make money. It also doesn't guarantee you won't lose money. If the market is falling in price, you will be buying more shares because the price is lower, but your overall investment in the stock will be losing money. If the stock starts to rise again, you will have more shares, and therefore make more money as long as the stock is above your buy price.

I am not a fan of dollar cost averaging in a majority of situations. However, that does not mean that I do not use it.

I have use DRIPS in my dividend investing accounts; each time I get a dividend, it is reinvesting into my stock at the price on the day of the dividend. It is essentially dollar cost averaging. The goal of that particular portfolio is income, and my time horizon is 30 years. I also use utilities, which do not fluctuation in price a lot. So less volatility means less probability of large losses.

I also have a retirement account, and money is deposited in the account every two weeks. And every two weeks, that money is invested into stocks and funds that I have already selected, regardless of price.