Will The 4 Percent Rule Work for Your Retirement Plan?

The 4 percent rule is at the heart of most retirement plans, and goes something like this:

- If you can limit your yearly withdrawals to 4% of your retirement nest-egg, your funds should last throughout your retirement.

All you need to do is figure out how much money you'll be spending each year, calculate how big your retirement fund has to be to keep your spending amount below 4%, and then keep on saving until you reach the appropriate retirement fund size.

Sounds good, right? But wait...there's a catch.

It's not actually a rule. It's just one conclusion from a much broader study done by three professors at Trinity University.

What is the 4 Percent Rule?

We all like things to be simple...short, sweet, and to the point. And the "4% rule" makes for a nice sound bite.- Estimate how much money you want to spend, per year of retirement

- Divide your estimate in step 1 by 0.04 (4%)

- The result is the portfolio size you'll need when you decide to retire

But reality is never that simple. Remember the study I mentioned? The 4 percent rule refers to one (just one!) retirement scenario where a retiree withdraws money each year from their nest-egg for at least 30 years; a nest-egg filled with stocks and bonds.

4% is the amount of the withdrawal in the first year of retirement.

The study assumed that the withdrawal percentage would increase with the cost of living, based on the consumer price index or CPI.

Using a number of different stock/bond mixes, the study concluded that "withdrawal rates of 3% and 4% are extremely unlikely to exhaust any portfolio of stocks and bonds" before the end of the 30 year period.

Most people stop investigating at this point. But wait, there's more. Ladies and gentlemen, we have a disclaimer from the authors!

- "...planning is emphasized because of the great uncertainties in the stock and bond markets. Mid-course corrections likely will be required, with the actual dollar amounts withdrawn adjusted downward or upward relative to the plan. The investor needs to keep in mind that selection of a withdrawal rate is not a matter of contract but rather a matter of planning."

Which means that you'll probably have some years when you take out less than 4%, and other years when you take out more than 4%.

Why Use the 4 Percent Rule?

People use the 4 percent rule because it's easy! You don't have to do much planning...just save, buy and hope...I mean hold. And you can find historical data that indicates the rule works...or at least seems to have worked in the past!Which means the general feeling is that this rule is "safe". As members of the Safe Investing community, you and I know that no investment or strategy is safe.

As pointed out in the article "Will the year 2000 retiree destroy the 4% rule?" over at www.investingforaliving.us:

- The first 10 years of a year 2000 retiree’s retirement results are worrying...he/she cannot tolerate even a few more years of poor investment returns and have their portfolio survive.

At this point, you may be wondering why investment returns are an issue. Think of each withdrawal you make as a loss. You no longer have that money to invest. And each year, that loss gets larger because of inflation.

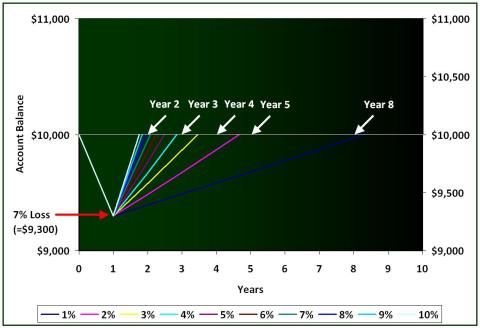

Remember this chart?

Time and Rate of Return Required to break-even after a One Year Loss of 7%

This is why investment returns are so important; if they're negative. You have to make more with less.

Is the 4 Percent Rule Right for You?

The 4% rule is a good starting point, and will give you a rough estimate of what you'll need for retirement. But don't stop there.Back in the early 2010's, Kiplinger Magazine stated that saving $1,000,000 dollars for retirement means you'll be able to get about $40,000 per year in income. The article also stated:

- "Considering that saving $1 million will only amount to about $40,000 per year for the average retiree, it’s easy to understand why retirement has become almost a luxury."

I'm guessing Kiplinger's isn't the only one who thinks retirement is a luxury...if you can call living on $40,000 (so maybe $30,000 after taxes) luxurious.

Saving $1 million dollars is no easy task to begin with; it requires sacrifice, discipline, and budgeting. But most people don't simply save $1 million dollars. We all need some help from capital preservation, consistent returns, and superior profits...in other words, the three steps to better investing!