Trading Money Management makes investing safe or risky

Trading money management is another facet of personal money management...and the most important one when it comes to investing.

Unfortunately, trading money management services are usually reserved for individuals with significant wealth.

Don't be confused. This doesn't mean that money management only important if you have a lot of money. All it means is that this type of service is only profitable for professional managers when an investor is wealthy! The reason is two fold:

- Money management is easier with larger amounts of money (i.e. less time)

- More money to manage means higher commissions and fees (i.e. more profit)

The info on this page will probably sound like common sense, but most investors and traders don't even think about it. As safe investors, you know the total amount of money you have to invest before you start investing.

You also need to figure out how many trading accounts you need, how much money to put in each one, and then how much money to put in each investment.

What is Trading Money Management

Trading money management is another decision-making process. This time, the process determines how much money to invest or trade. Ideally, this will be done in your planning phase, before you start researching investments.There are two aspects you need to address: Portfolio Sizing and Position Sizing.

Portfolio Sizing

Portfolio sizing is the process of figuring out how much money you want to have in each of your accounts.By accounts, I mean the minimum amount of money that you want to have in your checking account at all times, the balance of your savings account, the size of your emergency fund, the money in your trading accounts, and last but not least, how much money you currently and plan to have in your retirement accounts.

Definitely not the time to have eyes bigger than your stomach

The total amount of money available for investing (i.e. Portfolio or Account Size) is the balance of your investment and trading accounts.

Each account size will vary, depending on the your:

- Personal finance and investing goals (what you want)

- Personal financial statements (current situation)

- Personal budget (how you fund your accounts each week/month/quarter/year)

Position Sizing

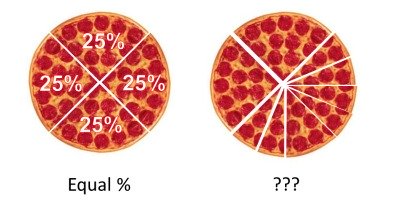

Position Sizing is the percentage of each account that you want to use for each trade or investment.

How you slice up your portfolio can have a big impact on your results

The amount depends on several factors, such as your:

- Investor type

- Portfolio size

- The largest loss you're willing to take

- Timeframe

- Personal finance goals