Weekend Stock Market Outlook

Stock Market Outlook For The Week of

May 29th = Uptrend

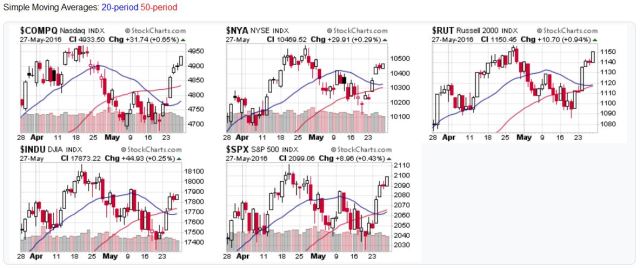

MOVING AVERAGES

Short-term (20 DMA): Uptrend

All the major stock market averages rose above their 20-day moving averages.

Intermediate (50 DMA): Uptrend

All the major stock market averages rose above their 50-day moving averages.

Long-term (200 DMA): Uptrend

All the major stock market averages rose or remained above their 200-day moving averages.

2016-05-29 - US Stock Market Averages

COMMENTARYLast week's "small rally" forced a complete reversal in the market outlook, from downtrend to uptrend, as the indexes reclaimed their 20, 50, and in some cases 200 day moving averages. With the 20, 50, and 200 day moving averages so close to one another, the potential for further whipsaw action over the coming weeks is very high.

On the positive side, the rally saw broad participation across all sectors...so your holdings probably did well too! The only real negative was declining trading volume as prices rose, which is typical before a three-day holiday.

Price/volume action still shows elevated levels of high-volume selling, but some of the distribution days are old enough to fall off the count.

Per OEW, the latest rally could extend a bit farther (the S&P500 is within 2% of the all time high), which is good news for short-term gains. However, OEW also indicates the severity of the next downtrend grows as we make higher highs.

For the detailed Elliott Wave Analysis, go to the ELLIOTT WAVE lives on by Tony Caldaro. Charts provided courtesy of StockCharts.com.

Moving Average Signals:

Uptrend = Market indexes remained above their moving average during the trading week

Downtrend = Market indexes remained below their moving average during the trading week

Buy signal = Market indexes rose above their moving averages during the trading week

Sell signal = Market indexes fell below their moving averages during the trading week