Savings Bond are just another form of Government Debt

A savings bond, like all other bond investments, is just another type of loan. In this case, instead of loaning money to a person or a company, this one is issued by a government to pay for money borrowed by that government.

Most of the time, when someone refers to a savings bond, they are talking about the ones issued by the U.S. Department of Treasury. You can purchase them if you have a Social Security Number and you're:

- A resident of the United States, or

- A citizen of the United States living abroad with a U.S. address of record, or

- A civilian employee of the United States regardless of residence

Savings bonds have been around for a long time, and have come in several different flavors. Currently, you can purchase:

- Series "EE" Bonds

- Series "I" Bonds

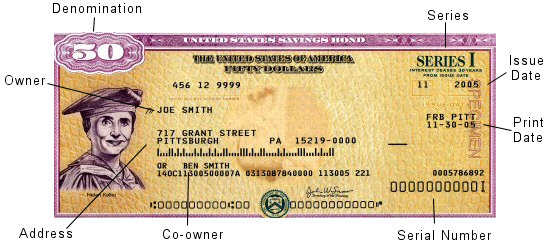

Example Series I Savings Bond

Source: www.treasurydirect.gov

As of January, the annual purchase limit for online savings bonds is $10,000 per series, for a total of $20,000.

Series EE Bonds

The Series EE bonds were first issued in 1980, replacing the Series E savings bond. These days, they only come in electronic form, as paper versions stopped being issued at the end of 2011.EE bonds are bought at face value (you pay $50 for a $50 bond), and interest is deposited electronically into your account. When the bond matures, you are paid the full value.

You can buy up to $10,000 (face value) worth of EE bonds during any calendar year. Also, if you decide to cash in Series EE bonds within the first 5 years of ownership, you’ll lose the 3 most-recent months' interest payments. After 5 years, you won’t be penalized.

Individuals and various entities (trusts, estates, corporations, partnerships, etc.) can all have TreasuryDirect accounts and own these bonds.

Series I Bonds

Series I bonds began circulating in 1998, and are available electronically or in paper form. These bonds are sold at face value and offer a fixed rate of interest, adjusted for inflation.Like EE bonds, you can buy up to $10,000 (face value) in any calendar year for the electronic version. If you decide that you want good old fashioned paper bonds, you can get them in $50, $100, $200, $500, and $1,000 denominations

Also like the EE bonds, if you redeem Series I bonds in the first five years, you’ll forfeit the three most recent months’ interest.

Why Buy Savings Bonds?

These investment instruments are "backed" by the U.S. government, meaning that the government is the one that pays you interest.Since the possibility of a default by the U.S. government (i.e. bankruptcy) has always been very low, savings bonds are considered to be the safest investment out there. This doesn't mean it can't or won't happen; only that the probability is really low!

U.S. savings bonds also provide tax advantages. A bondholder does not pay state or local taxes on the interest from the bonds. You can also defer paying federal taxes on the interest (either when you cash in the bond or when it matures).

As an added bonus, they really are "safe"! Each one is registered with the U.S. Treasury’s Bureau of the Public Debt, so you can get replacements if they are lost, stolen, or destroyed.

And not only are they useful types of investments, but they can also be used to help you achieve other financial goals, such as:

- Financing higher education

- Supplementing retirement income

- Gifts (birthdays, graduation, etc.)

Even minors (children under that age of 18) can own savings bonds!

Safe Investing Tip:

Several readers asked about "E Bonds", "H/HH Bonds". These were predecessors to EE Bonds, but are no longer issued by the U.S. Treasury. That doesn't mean they aren't valuable! Check with your local bank about how to cash them in.

Factors that affect the price of Savings Bonds

Series EE Bonds purchased on or after May 1, 2005, earn a fixed rate of return, so you can figure out what the bonds are worth at any time.EE Bonds purchased between May 1997 and April 30, 2005, are based on 5-year Treasury security yields and earn a variable, market-based rate of return.

In either case, visit TreasuryDirect.gov (they have a savings bond price calculator available for you to use) or the U.S. Department of Treasury's Bureau of the Public Debt.

Where Can You Buy Savings Bonds?

The fastest way to buy Series EE bonds is through the government, at TreasuryDirect.gov. The bonds are issued directly to you in your TreasuryDirect account.You have access to your account 24 hours a day, 7 days a week, and can can set up an automatic purchase schedule for as little as $25. Paper bonds aren't an option though.

Safe Investing Tip:

Need some help using the website? Download a free online cheatsheet at http://www.treasurydirect.gov/instit/savbond/otc/HowtoopenanaccountinTreasuryDirecttipsheet.pdf.

Mail Order is another way to go, if you're interested. You'll still have to go online (TreasuryDirect.gov), print out and complete an order form, then mail it to the address shown on the form.

Banks and other financial institutions (including Online Banks) also offer savings bonds. Paper bonds can be printed and then mailed to you within 15 business days. Your bond's issue date reflects the date of purchase so that no interest is lost.

And there's always the "Payroll Savings Plan". Through your employer, you can buy EE Bonds using the payroll savings option at TreasuryDirect.gov. Click here for more information and the necessary forms.

Safe Investing Tip:

In many cases, you can trade in paper bonds for electronic ones at TreasuryDirect.gov, through their SmartExchange program. Click here for more information.